Are you currently short on funds but the bills are already in the mail? It becomes quite tough to prioritize one interest over the other. In situations like these, apps similar to Deferit can come in handy.

While paying your bills on time is one of the things that Deferit covers, other apps can take care of your financial needs. These apps are called BNPL which allow you to buy now and pay later up to a certain credit limit.

However, there are a bunch of them, and locating the legit ones can be a tough nut to crack. Over a week of in-depth research, I have discovered the most authentic ones. So, what are you waiting for?

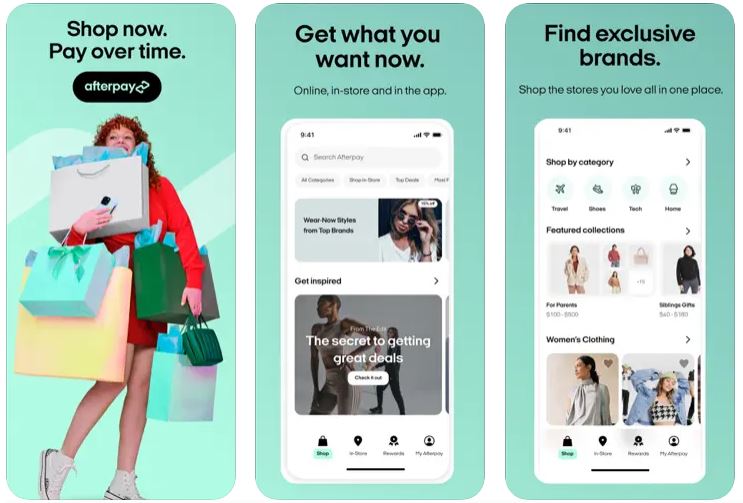

1. Afterpay

Afterpay takes care of all your purchases without you having to worry about paying the full price. The app allows you to buy stuff in installments of four. You can make the first downpayment upfront, and the rest will be paid by Afterpay.

You can pay the app back in four installments over four fortnights. The app’s credit limit begins at $600 but increases with time based on your repayment history, timeliness, and how long you have been using the app.

Not only does it allow you to purchase stuff from their in-app shop, but you can also use it at stores using the digital Afterpay Plus Card which can be added to the Apple Wallet or Google Wallet in your phone.

If you don’t have the Plus card which comes with a $9.99 membership, you can still pay in stores that accept Afterpay. Paying using Afterpay is a simple process just like you would do with any other card.

Comparisons with Deferit

While both apps work on a similar principle, Afterpay has a much larger use case compared to Deferit. Here is a closer look at what makes the two different:

- Deferit works only for bill payment. It can be related to any kind of bill – rent, electricity, mobile phone, internet, etc. Afterpay works with all kinds of purchases.

- Both apps allow you to repay bills in four fortnightly installments.

- Deferit charges a fee of $14.99 per month while Afterpay Plus costs $9.99 per month.

Key Features

- Payback in four installments over 60 days

- Credit limit begins at $600

- Afterpay Card works at all stores that accept Afterpay payments

- Afterpay Plus Card works at all stores that accept Apple and Google wallets

- The app allows you to keep track of all your spending and upcoming payments

| Pros | Cons |

|---|---|

| Instant approval process | $9.99 membership fee for Afterpay Plus |

| Reduces your financial burden | Afterpay Card (non-plus) works only in stores that support Afterpay |

| The amount that you pay back is interest-free |

Conclusion

Having been using Afterpay Plus for over a year now, I have always found the app to be of great help to me, especially when I am making a bigger purchase. I have also found the app’s UI to be very easy to navigate. What surprised me the most was how quick the approval process was. Do try it if you are looking for apps that allow you to buy now, and pay later.

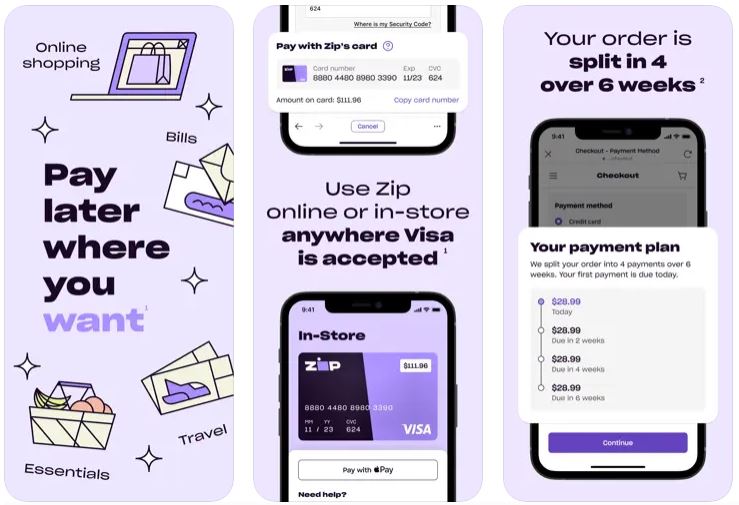

2. Zip

Zip has been around for a while, and was known as Quadpay before this rebranding. The app works on the same principle as most other Buy Now, Pay Later apps and allows you to pay in four equal installments over four fortnights.

The app is fairly easy to use and their in-app store has a very large selection of brands where you can buy from. Zip also allows you to add a card to your Google Wallet or Apple Wallet to make in-store purchases.

Unlike other BNPL apps, Zip goes through every purchase and approves of it before you can use it to buy stuff. To use Zip, you need to have a pre-existing Debit or Credit Card linked to the app.

The first installment is already made by you at the time of the purchase, and the next three happen over the next three fortnights. The app charges $1 per installment and $7 as late fees if you miss paying back on time.

Comparisons with Deferit

Deferit is an app that you can use to pay off your bills but it isn’t really of use when it comes to shopping. Zip, on the other hand, focuses on shopping and allows you to pay for your purchases in four installments.

Here’s a look at some more comparisons:

- While Deferit has a $14.99 monthly fee, there’s no such fee with Zip. However, you pay $1 per installment.

- Deferit does not charge a late fee, but if you are late on Zip, you will be charged $7

- You cannot use Deferit to pay bills but you can use Zip’s BPAY service to pay bills as well

Key Features

- Pay in four installments over 6 weeks

- Supports online payments as well as in-store payments

- No monthly membership fees

- Deducts installments straight from your linked card

- $7 fees for late repayment

| Pros | Cons |

|---|---|

| No monthly membership fees | A high charge of late fees |

| Sends notifications and reminders before installment repayment dates | Can compel you to make impulse purchases |

| Helps build a credit history |

Conclusion

As a frequent user of many BNPL apps, Zip stands out to me because it does not charge me an additional monthly charge. While there is a $1 charge per installment, that is negligible compared to the amount that apps like Deferit and Afterpay charge. Lastly, I am also a big fan of the Zip UI. The app is easily navigable.

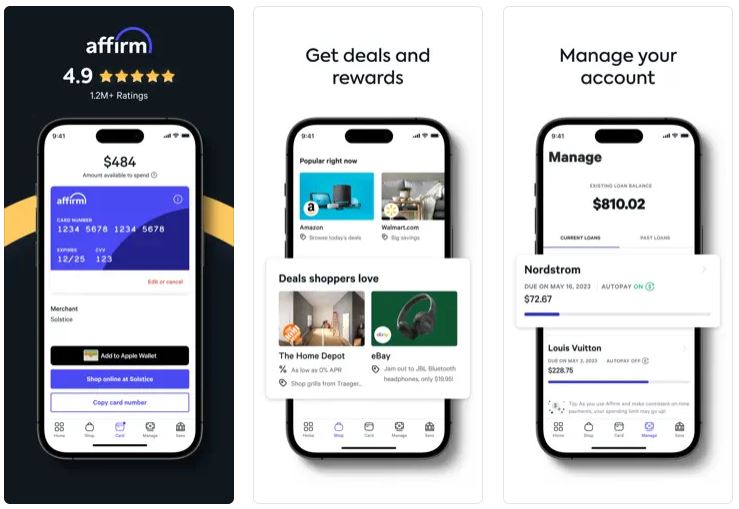

3. Affirm

Affirm started as a competitor to Credit Cards. The company claims that Credit Cards can end up costing you a lot, and Affirm offers you easier credit and repayment terms. Another cool thing about this app is that it does not charge any kind of fees (including late fees!).

Affirm supports both, online as well as offline shopping. You can choose to pay at the store on the checkout, or you can use a virtual card issued by the app.

Unlike other BNPL apps, Affirm has two payment options: you can choose to pay in the regular 4-part installment every fortnight, or you can choose to pay in monthly installments for bigger purchases.

There is no interest applicable in regular 4-part installments. However, if you are paying in 6 or 12 monthly payments, you will be charged interest at 15% APR.

Comparisons with Deferit

As we have seen with other apps above, the primary difference comes down to the fact that while Deferit is only for bills, you can use Affirm for shopping at regular stores. This is the biggest difference between the two.

However, this isn’t the only point of comparison, here’s a closer look at what’s similar and what’s not:

- Deferit has a monthly charge of $14.99 while there is no monthly fee associated with Affirm

- Deferit offers only a four-installment payment system over 60 days while Affirm offers that, as well as a monthly payment system

- You cannot use Deferit for in-store checkouts while Affirm supports that

Key Features

- Pay using Affirm at any store that accepts virtual credit cards

- No interest on regular payments over 4 fortnightly installments

- 15% APR interest on monthly payments

- No hidden charges or fees, not even late fee

- Tells you the total amount you have to pay upfront

| Pros | Cons |

|---|---|

| Convenient to use and an app that doesn’t confuse the users | 15% Interest APR on monthly payments |

| Transparent payment system without any hidden charges | You might end up over-spending |

| Does not charge any late fees |

Conclusion

As an affirm user, I have never had a problem making in-store payments. I appreciate the fact that their payment system is transparent and tells me about the overall cost and interests up-front, especially on the monthly payment system.

While an interest of 15% is somewhat steep, the app works well for me when it comes to making big-ticket purchases.

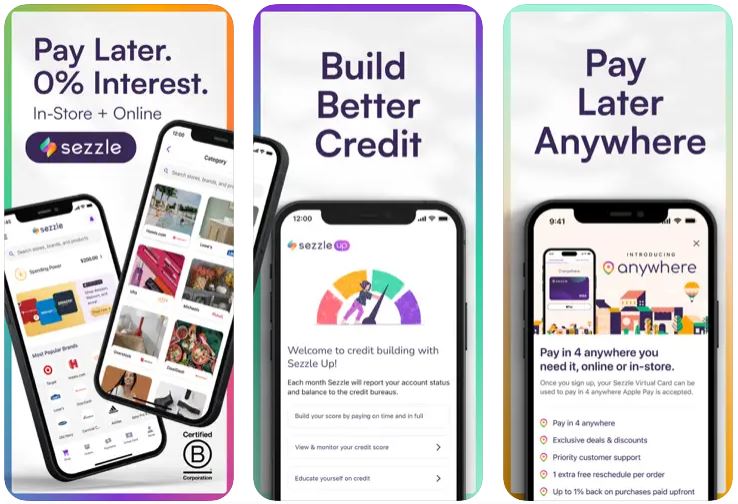

4. Sezzle

Want to buy stuff but don’t want to pay the full amount for it right away? Look up for Sezzle. The app gives you a lot of features for purchasing things online, including multiple repayment options.

You can choose to pay back the full amount over 2 weeks, or over 6 weeks with 0% interest. However, if you want to go monthly, you can choose between 3 to 48 months of payments where rates can vary between 5.99% to 34.99% APR.

While the free version of Sezzle allows you to make payments in four installments across a limited online collection, Sezzle also has two more plans. These are Sezzle Premium and Sezzle Anywhere.

Sezzle Premium gives you access to better in-app brands, as well as exclusive discounts and deals for $9.99 a month. Sezzle Anywhere comes in at $16.99 a month and allows you to make in-store purchases anywhere Apple Wallet or Google Wallet are supported. This is Sezzle’s competitor to Afterpay Plus.

Comparisons with Deferit

Sezzle and Deferit are two very different apps altogether. After using both of them for over a year, I continue to be an active user of both apps, but for two different purposes.

Here’s a closer look:

- Sezzle is meant for shopping while Deferit is only meant for paying bills

- Sezzle offers three different payment methods – 2 or 4 installments, or monthly installments. Deferit only accepts 4 installments over 60 days.

- Deferit’s monthly membership costs $14.99 while Sezzle Premium comes in at $9.99 and Sezzle Anywhere is priced at $16.99

Key Features

- Pay back over a period of 2 or 4 installments, or pay monthly

- No interest for 2 or 4 installments, a variable interest rate for monthly payments

- Get exclusive deals and discounts on the Sezzle app

- Supports in-store payments for Sezzle Anywhere users

- A dashboard to track your spending and remaining credit

| Pros | Cons |

|---|---|

| Allows me to pay over 2 or 4 installments, making payments convenient | At $9.99 and $16.99, the membership plans are somewhat expensive |

| A lot of premium brands are supported by the store within the app | Interest on monthly installments can go as high as 34.99% APR |

| The app’s transparency of payments is one of its strongest suits |

Conclusion

Usually, when I navigate through BNPL apps I feel like they just want me to spend more and more. With Sezzle, the UI is simple and comfortable to navigate through. However, I must point out that there is a significant failure rate with Sezzle, especially over in-store payments.

This often bothers me especially when I consider the high price point of its Sezzle Anywhere plan at $16.99. But in all other cases, I find the app to be pretty good.

5. Klarna

Like most other apps on this store, Klarna offers you the ability to shop now and pay later. However, there’s more to Klarna than just that. The app also lets you compare the prices of products across multiple stores and helps you find the best deal.

The app also lets you keep track of your spending habits. You can even track your shipments using Klarna, and it even comes with a CO2 tracker which gives you an idea of how much your carbon footprint is per order.

There are four payment options in Klarna. You can choose to pay the whole amount instantly, or you can choose flexible payments. These flexible payments can be done over 4 installments, in 30 days, or monthly payments for up to 24 months.

The first three are interest-free while the last option ranges between 7.99% to 33.99% APR. This card costs $4.99 a month and can be used at every POS where VISA cards are supported.

Comparisons with Deferit

Deferit is just an app to pay your bills. Klarna allows you to do much more than just payments. The multifunctional nature of the Klarna app makes it unique and stand out from Deferit.

Here’s a quick comparison between the two:

- With Klarna you can compare prices, order for stuff, track your shipment, and even track your carbon footprint. However, with Deferit, you can only pay bills.

- Membership to Deferit costs $14.99 a month while Klarna has no membership charges. However, the Klarna card costs $4.99 a month.

- Deferit and Klarna both support flexible payments featuring a 4 installment plan which can be paid over 60 days. Klarna has other options as well.

Key Features

- $5 joining reward + deals and discounts on brands

- Supports interest-free paybacks in 2 or 4 installments, or at the end of the month

- Supports monthly payments of up to 24 months with an added interest

- Get a Klarna Card for a monthly fee of $4.99

- Track your shipment as well as the carbon footprint on the Klarna app

| Pros | Cons |

|---|---|

| The Klarna card supports payments abroad as well | High rate of interest on monthly payments |

| No additional interest is charged | $4.99 per month for the Klarna Card |

| Fast and safe means of making online payments |

Conclusion

Klarna is undoubtedly one of the best alternatives to Deferit, especially when it comes to making flexible payments. The app provides a lot of payment options and most of them are interest-free.

Lastly, even though it costs $4.99 a month, the Klarna Card is pretty handy and I love the fact that I can make POS transactions using that card even when I’m on a trip abroad!

6. PayPal

Paypal is one of the most iconic finance-related apps out there. It was among the pioneers of online payments and continues to dominate fund transfers.

As a freelancer who often has international clients, I make use of PayPal for all my payment needs. However, of late Paypal has also introduced a Buy Now Pay Later option. The best part about it? No late fees!

The app allows you to make flexible payments where you can buy anything in four interest-free payments. The app has you making the first installment instantly as a downpayment and the next 3 payments over the next 6 weeks.

There’s 0% interest on these payments. However, if you choose to pay monthly, you can choose to pay over 6, 12, or 24 months. These are not interest-free and might cost you between 4.99% to 35.99% APR. Repayments on PayPal are also pretty easy – you can do them via Bank, Credit Card, or Debit Card.

Comparisons with Deferit

PayPal is in a whole different league when compared to Deferit. PayPal supports online fund transfers and is an online wallet. BNPL features are just an add-on that you get here.

Deferit, on the other hand, is a pure-play deferred payments service provider that can pay your bills. Here are some more differences between the two:

- PayPal’s BNPL offers repayment in four installments, as well as monthly returns over 6, 12, and 24 months. Deferit does not provide monthly payment support.

- Deferit charges $14.99 a month for its monthly membership. There are no additional fees for PayPal’s BNPL.

- PayPal and Deferit both provide 4-installment payments at 0% interest

Key Features

- Pay in 4 installments and buy between $30 to $1500

- Choose monthly payments to buy between $199 to $10000

- 0% interest on 4 installments

- PayPal provides purchase and fraud protection

- Repay via Debit Card, Credit Card, or Bank Account

| Pros | Cons |

|---|---|

| Familiar PayPal UI with ease of navigation | High rates of interest on monthly payments |

| Purchase and Fraud protection | Can tempt you to overspend |

| 4-installment payments won’t affect your credit score |

Conclusion

PayPal’s BNPL is by far one of the best and the most trusted names out there when it comes to Buy Now Pay Later services. As someone who has used PayPal for years, I would strongly recommend this app.

7. Zilch

Zilch, which means ‘nothing’ is an exceptional name for an app where you have to pay nothing extra! The app has 0% interest, 0 fees, 0 overdrafts, and 0 impact on your credit score when you use it.

In terms of payments, it supports the standard 4-installment payments over six weeks without charging any interest. However, if you wish to, you can pay the entire amount at once and get 2% back as a reward on the Zilch app.

Zilch works across the US and the UK. The best part is, that you can pay using the Zilch virtual card (powered by Mastercard) at all POS places that support Mastercard.

Additionally, Zilch also supports a lot of major online retailers, including Amazon and Best Buy among many others. You can choose to pay 25% or 50% upfront and the rest can be split across weeks.

Comparisons with Deferit

Deferit and Zilch operate in the same space but are different compared to each other. Deferit, on the one hand, supports only the payment of bills, while Zilch has a much broader use case.

Here’s a closer comparison:

- Zilch and Deferit both support payments over 4 installments spread over 60 days. However, Zilch also offers an instant payment option.

- Zilch and Deferit both don’t charge any interest on these 4-installation payments

- Deferit charges $14.99 per month for their service, Zilch is free to use

Key Features

- Supports all POS units where Mastercard is supported

- Supports most leading online retailers including Amazon and Best Buy

- Provides 4-part installments over six weeks

- Supports upfront down payments of 25% or 50%

- Provides 2% rewards every time you pay the entire amount at once

| Pros | Cons |

|---|---|

| Mastercard support opens up a lot of avenues to buy from | Can compel you to spend more than your budget permits |

| Good collection of online retailers supported | High interest rates on places that don’t support Zilch |

| Rewards can help you get discounts on future purchases |

Conclusion

Zilch is a neat app to make BNPL payments. I use it pretty frequently while making online purchases, especially when I want to complete the purchase in one go. I also like that the app doesn’t give a big limit straight up and unlocks the credit limit slowly which ensures that I spend responsibly.

Frequently Asked Questions

Apps such as Deferit and Zip allow you to pay your bills in installments. These are good options to use when you are short on cash and want to defer your payments.

While Sezzle is mostly known for its in-store purchases, you can also use the app to pay bills. However, do note that not all bills might be supported by the app.

No, as of this writing, Affirm cannot be used to pay Credit Card bills. However, there’s much more you can do with Affirm, such as in-store shopping and online shopping.

Wrap Up!

Different people tend to have different opinions about Buy Now Pay Later apps, but when you look at the overall picture, they are a net positive for society.

However, you must use them with caution because these apps can tempt you to overspend beyond your budget as the payments have to be made at a later date. That aside, I hope this list helps you.

Leave a Reply