If you frequently transfer money using online platforms, the Chime app makes it even more convenient. I discovered this app when I moved for higher studies and often needed money from home.

But, how is it possible to send money from Chime to the Cash app when both of them do not integrate? Well, it is simple, by linking them. Furthermore, you can also send money to non-Chime users.

I’ll get to it a bit later, but first, let’s start with chime to cash.

Method 1: Add Chime as a Bank

This is where the linking of Chime to the Cash app is done. All you need to do is add Chime as your bank in the Cash app. Follow the simple steps below:

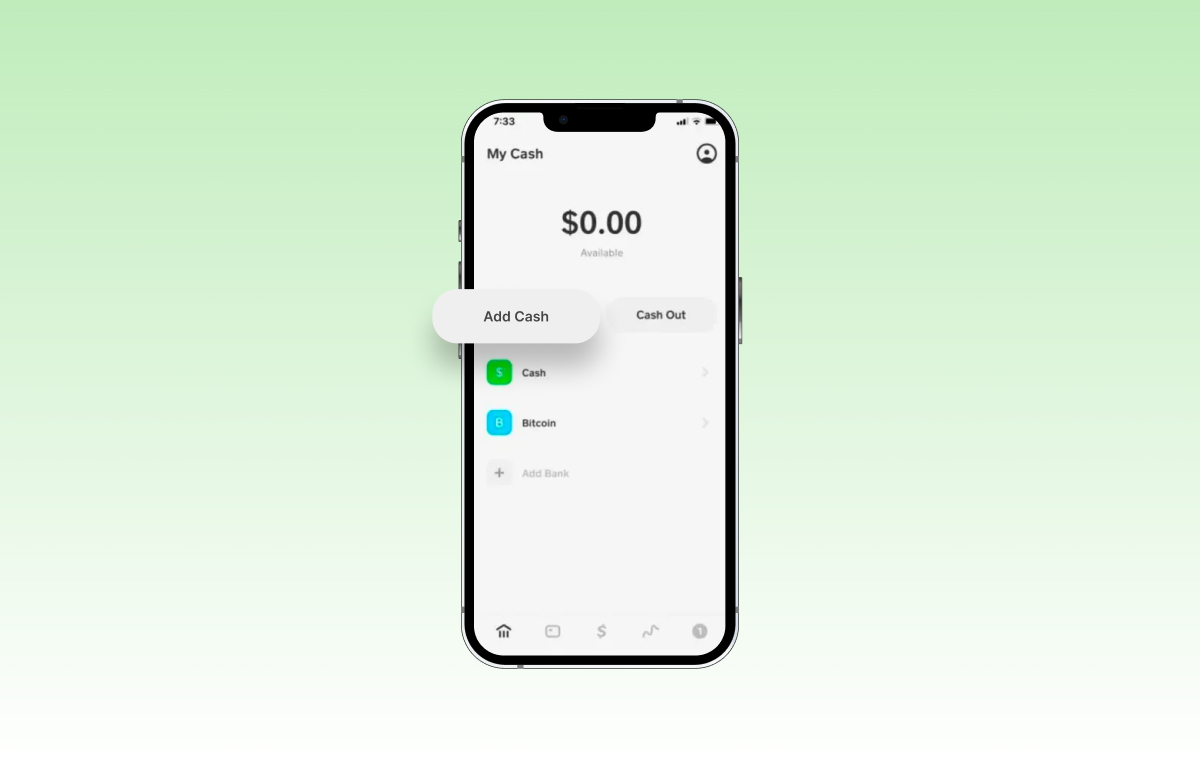

Case 1: You do not have a linked account

- Open your Cash app and go to your profile.

- Select “Add Bank”.

- Now choose the “Chime” option.

- A login page will open.

- Log in to your Chime account, and your accounts will be linked.

- Now, open your Cash app and enter the amount that you wish to transfer.

Note: Since the Chime account is listed as a bank, the money will be directly transferred from the Chime account.

Case 2: You do have a linked account

In this case, replace it with your Chime bank account details.

- Click on the bank name followed by Replace Bank.

- Enter Chime bank account details.

- With Plaid, tap continue and enter “Chime” in the search bar.

- Enter Chime account login information.

- Enter the amount you want to send.

- Tap “Pay”.

That’s it. You’ve successfully transferred the funds.

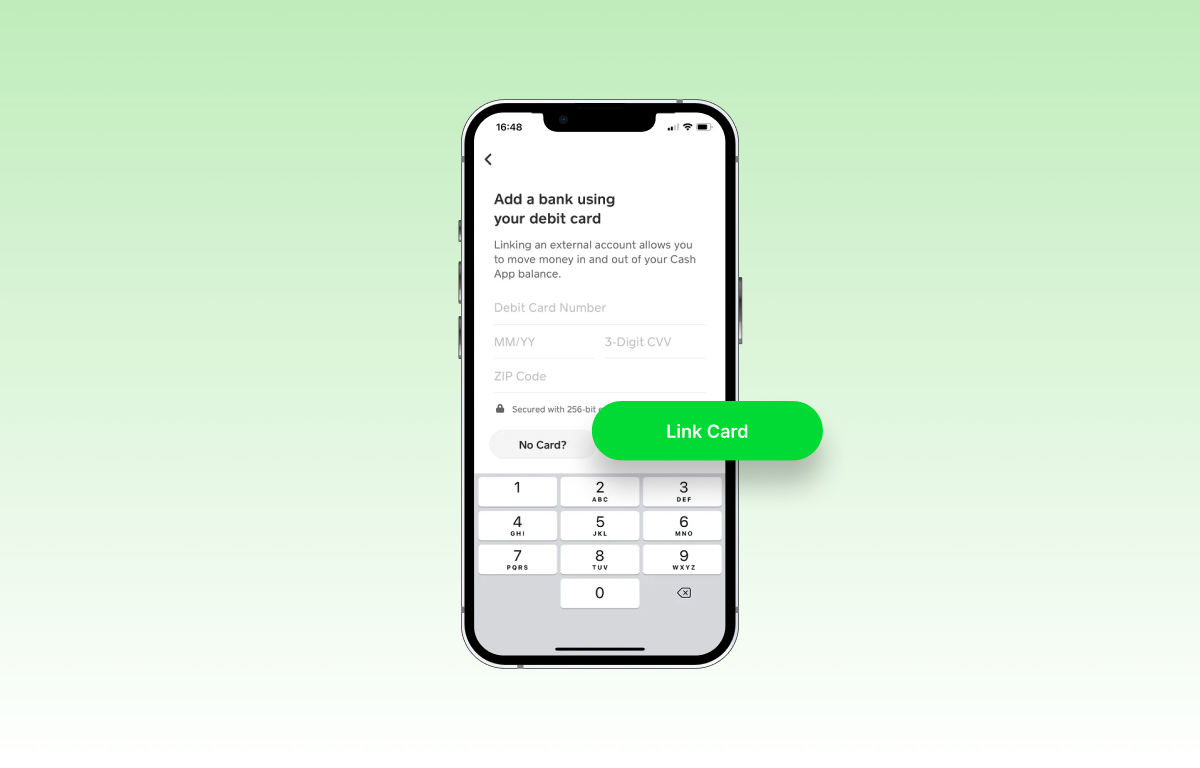

Method 2: Add Chime Debit Card

To make any transaction, you’ll have to link both apps. For this, you’ll need a Chime debit card.

- Click on your profile picture in the top-right corner.

- Select the “Linked Banks” option.

- Tap on the “Link Debit Card” option.

- Add Chime card details and tap “Link Card” once filled.

- Tap the $1 icon in the lower-left corner.

- Go to the “Add Cash” option.

- Enter the amount.

- Select “Add”. Voila!

Steps to Pay a Non-Chime User

The most useful feature of Chime is that it allows you to send money to non-Chime users, including the Cash app. Therefore, for emergency fund transfers, you can use the Pay Anyone feature.

The steps for this method are mentioned below:

- Go to the Chime app and enter your PIN.

- Select the “Pay Anyone” tab, located at the bottom.

- Provide access to your contacts.

- Select the contact you want to send money to.

- Enter their phone number or email.

- Enter the amount and tap “Pay”.

The receiver will get a notification on their email, and they don’t need to download the Chime app to claim the funds. However, the receiver must have an active debit card.

Frequently Asked Questions

You can transfer up to $5000 if you have an activated card. If you don’t have an activated card, your transaction limit is $500.

Standard transfers take around 1-3 business days. However, if you want to transfer a large amount and want to pay instantly without attracting a fee, you can link your Chime bank account to the Cash app.

Chime doesn’t provide cash advance service. However, many apps like Klover give advances with low to no interest.

There are no fees for using the “Pay Anyone Transfer” service in the Chime app, and the Cash app also does not charge for receiving funds. This makes it a win-win situation.

Wrap Up!

Chime works well with the Cash app. An essential criterion is ensuring that your linked accounts enable external transfer. You must also verify if the Chime and Cash apps both support the same bank.

Lastly, it’s best to review app policies to be sure of transaction periods and any instant fee, if applicable.

Leave a Reply