In a day and age where everyone is complaining about users’ behavioral and analytical data being sold for millions in an illegitimate way, an app called Klover does that completely legally without compromising your actual information. But how exactly does that work?

Well, Klover is a brilliant app that lends you money without any interest or fees. But the catch is that you have first to link your bank account with Klover so they can auto-sweep the due amount when your paycheck comes. Secondly, you have to allow Klover to share some of your data (keeping your identity under wraps) with third-party advertisers.

As horrible as it may sound, I still decided to use the app to know the fuss about this Illinois-based company with merely a few dozen employees. Let me explain here how it works.

Does Klover Work?: Detailed Review

I downloaded the app last month, and I have been taking cash, paying bills and repaying the money back since then. So far, I haven’t been contacted directly or indirectly by any financial institution regarding their products which may indicate that my data is being compromised by the app.

The ads are surely annoying, but that is the price you pay for interest-free instant cash. The UX/UI is the best thing about the app. The customer support needs a lot of improvement on the other hand. Let us take a look at some of those aspects in detail here.

Key Features

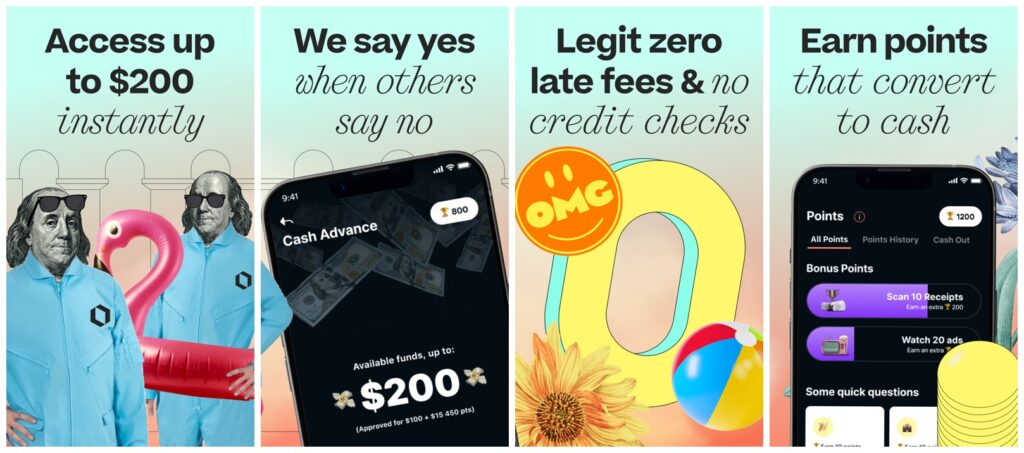

Before moving on to understanding how exactly Klover works, let us take a look at some of its key features.

- Interest-free short-term loan

- Instant cash

- No hidden charges

- No credit check runs

- Bill payments & rewards

- Anonymous profiles

- Earn points through surveys, watching ads, and other app engagement practices

- Dashboard to track all your activities

How does it work?

You have to enter the basic details like your name, email, and contact number to sign in. You then have to link your bank account with the app. The verification process takes up to 48 hours, but it happened much quicker in my case.

You then ask for a “boost” which is a cash advance. It takes a couple of days for the amount to reflect in your account, but with a little premium, you can receive the money on the same day. The app sweeps the money from your account when your paycheck comes. It is as simple as that.

Here are a few things you need to use the services of the Klover app:

- A well-functioning bank account

- A job with regular paychecks (at least 3 consecutive deposits) reflected in your account

- Only available for citizens in the USA

- For people aged 18+ only

You can get cash advances up to $200 for free until your next paycheck deposits in your account. The request for a cash advance is approved and executed within a couple of days, but if you want the money on the same day, you have to pay a premium between $1.99 and $14.98.

If you want the app to help you with financial management (i.e., your loans, credit card management) with some of its dashboard tools then it costs you $3.99 in subscription.

How Does Klover Makes Money?

When we sign up for Klover, it asks us to agree on allowing the app to share user data (analytics) for market research and advertising. They promise not to reveal our identities or contact details, though. But based on our transactional behavior, we are served with relevant ads, and that is where Klover makes money.

So if you are someone who is concerned about your data, Klover might not be the best option for you.

Safety & Security

The app is quite secure in its transactions. The terminals seem leakproof and fast. I didn’t fear linking my bank account with the app for one bit. The verification process, as they say, could take up to 48 hours, but mine was done within a day.

There is a privacy policy in place, and so far, I haven’t received more than the usual number of spam or ad attempts across the apps. The app also promises to use 256-bit encryption. But as things stand, we must trust the app when they claim that they will be protecting our identities.

User Interface and Design

The app is built for the new generation of users who believe in interest-free borrowing. It is pretty evident in its design which has bold typography and overlapped banners. The app uses a shade of orange for its text, data, and graphs, pitch black for dark mode, and white for normal mode in its background.

The bold typography is eye-catching. Every different type of reward point has a thumbnail on it which is pretty cool. On the user experience front, the app is fairly quick, especially with its transactions.

User Reviews and Ratings

It is to nobody’s surprise that the availability of interest-free and instant cash is the most popular aspect of the app among its users. There aren’t any visible complaints about the safety among the reviews of the app but people are a bit skeptical in general about their privacy policy.

What could be encouraging for the app is that more and more people are now talking about the finance management tools like the dashboard that comes with the premium subscription. The design language and speed of cash advances seem to be the two most popular features of the app.

Pricing vs Value

The bottom line is that you get up to $200 cash instantly without a credit check or without any interest or fees. That should be enough for you to believe that the app is worth using. Klover tries to make it a level playing field by allowing you to earn points by watching ads and filling out surveys.

These points can be redeemed with your transactions or bill payments. The monthly subscription fee of $3.99 for financial management tools and saving tips seems a bit of a stretch, but if you use the app to its fullest and earn enough points from it, the subscription fees may then start making sense to you.

Klover App Alternatives

Apps like Venmo have had a stronghold in this category. So obviously, it acts as the gold standard. Here are some apps that you can try as alternatives to Klover Chime, Dave, MoneyLion, Earnin, and many more.

Customer Support

Like any modern-day app, Klover also has an AI-enabled chatbot, which is pretty accurate in its responses. You can also email the support team for your queries. You will get a response from them straight away in an email, but the resolution depends on the nature of your query. As per me, they need to work on their customer service.

| Pros | Cons |

|---|---|

| Instant cash | Analytical data vulnerable to advertisers |

| No credit checks | Have to link bank account |

| Earn & redeem points | |

| Fast transactions | |

| Financial management tools |

Frequently Asked Questions

The Klover app is completely legit and abides by data security laws. It has a 256-bit encryption in place and uses credible resources to link your bank accounts to the app.

The app suggests that debit card verification may take 3 business days, but it also hints that most verification processes are done within minutes.

Yes, you can transfer money from CashApp directly into Klover instantly or within 1-3 business days depending upon your membership tier.

There is a subscription fee for Klover, which is auto-swept every month. Other than that, there are no charges on transactions and borrowings.

It takes up to 3 business days for you to get money from Klover. If you have subscribed to Klover, then you can get the money instantly.

Wrap Up!

Who does not love free cash? But as the famous saying goes, if you get something for free on the internet, then you are the price. Advertisers may not know our identities from Klover but interest-free instant borrowing comes at the cost of exposing our transactions.

Leave a Reply