Unlike other cash advance apps, Solo Funds provides both borrowing and lending, making personal finance easy for everyone. However, if it doesn’t suit you anymore, there are a bunch of alternatives.

While it’s beneficial to have multiple choices, not all of them are ideal. And if you’re confused about picking the right one, you’re in the right place.

For the past three weeks, I have explored over 18 apps similar to Solo Funds. I tested them for their legitimacy, cash advances, user interface, functionality, efficiency, charges, and more.

After in-depth analysis, I’ve compiled a list of the top 7 alternatives that will enable you to align with your financial goals for 2024.

So let us begin without any delay.

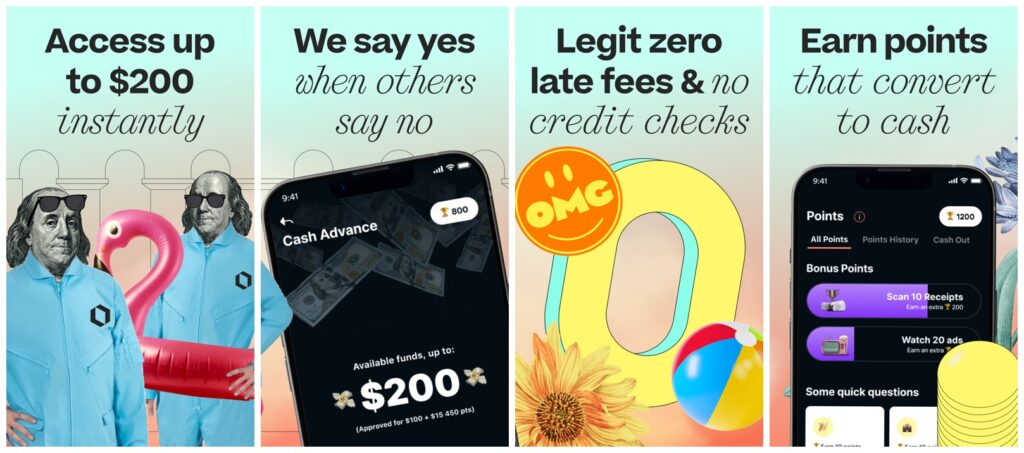

1. Best of All: Klover

Klover is hands down the best alternative. It is your go-to for cash advances and loans. The app offers an intuitive interface that offers tailored financial solutions by analyzing your spending habits.

Klover eliminates interest charges or credit checks, serving as a dependable safety net. You can access your wages before your regular payday. The app also offers financial wellness tools to enhance money management skills.

I found the app seamless with quick cash advances, and the app’s transparency impressed me. The platform was handy for higher loan amounts, responsive customer care, and a user-friendly interface.

Comparison with Solo Funds

Compared to Solo Funds, Klover offers similar features, while the apps differ in other aspects. Solo Funds primarily offers optional low fees, while Klover provides a $100 advance based on your bank account eligibility.

Both feature a quick approval process and user-friendly interface and offer tailored financial solutions.

Key Features

- Offers advance amounts ranging from $5 to $200

- Earn points to get advances on cover fees by uploading receipts, watching videos, and taking quizzes

- Withdraw money from your bank account at least 7 before your payday

- Access instant funding time with an express fee

| Pros | Cons |

|---|---|

| Offers higher loan amounts as compared to Solo Funds | Slightly higher interest rates as compared to other apps |

| Ensures seamless transactions for borrowers and lenders | Offers limited access in specific regions |

| Provides instant assistance and guidance for users | Focuses more on more extensive financial needs and might not be suitable for short-term cash needs |

For more detailed breakthroughs, read the Klover app review.

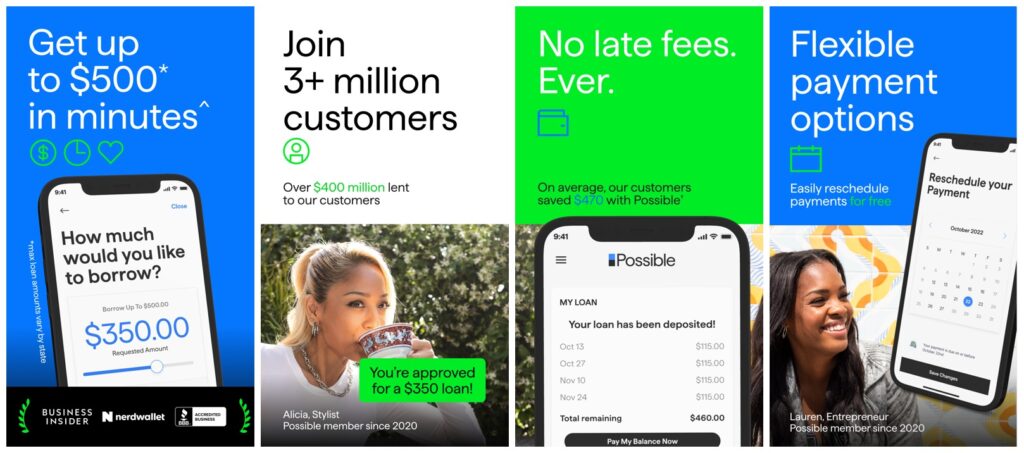

2. Best Runner Up: Possible Finance

Possible Finance is a cash advance app that rewards you with an increased credit score for timely repayments. The app offers short-term instalment loans up to $500 with a term of two months, to be repaid in 4 equal instalments.

I experienced a quick turnaround time with the app, as fast as 1 business day. Possible Finance offers a fixed interest rate type with a 2-8 weeks loan term.

The app stands out in its simplicity and accessibility. It caters to your diverse financial needs, enabling access to cash and flexible repayments.

Comparison with Solo Funds

Possible Finance offers short-term instalment loans with a two-month term, while Solo Funds has a shorter term of only 35 days. However, Solo Funds is more expensive than Possible Finance.

Therefore, you can expect to pay $15-20 for every $100 you borrow on Solo Funds. Both apps offer quick access to funds. However, their rates vary by a large margin, making Possible Finance a better option for reasonable rates.

Key Features

- Offers 150% APR (average percentage rate)

- Doesn’t consider credit score for approval

- Allows a 29-day grace period with hardship repayment options for exceptional cases

- Deposits funds into your account in 1-2 days

| Pros | Cons |

|---|---|

| No prepayment penalties | Doesn’t accept partial payments |

| Payment dates are based on the pay schedule | Offers lower maximum amount than Solo Funds |

| Offers longer terms than Solo Funds | Implements high mandatory fees |

| Reports payments to credit bureaus for an increased credit score |

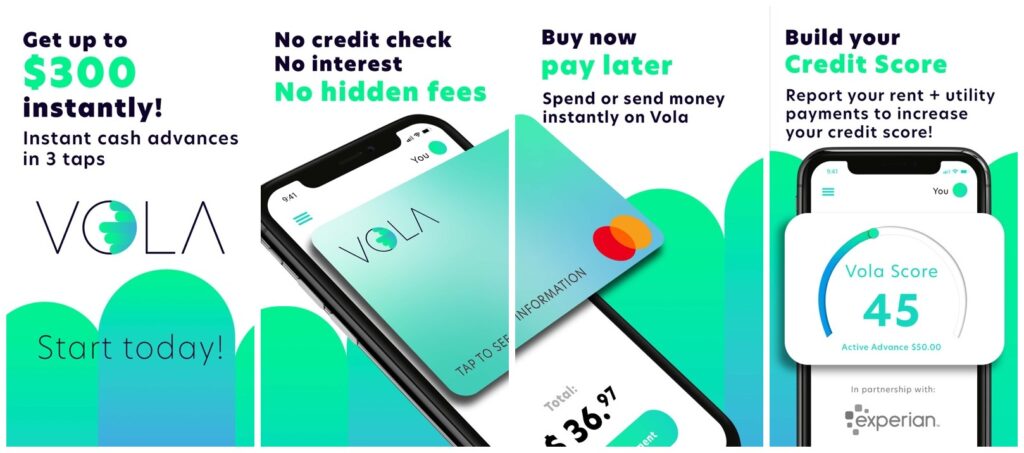

3. Best for Students: Vola Finance

Vola Finance is specifically designed to address the financial needs of college students. The app focuses on lending small loans. Vola also offers insights into educational content to make students more financially savvy.

The app has a smart algorithm that breaks down your spending, helping you make smarter decisions. It also offers tailored financial content based on your history to make money management easy.

The app lends up to $300 without a credit score history within minutes. You can also request a payment extension through the app for loan repayments.

Comparison with Solo Funds

I found interesting similarities and differences when I compared Solo Funds and Vola Finance. It also offers quick access to cash. However, Vola focuses on small loans amounting to $300, while Solo Funds offers up to $575.

A distinguished feature of Vola is that you can access cash instantly, while Solo Funds take up to 3 days to confirm whether your loan request will go through. Both the apps offer a seamless navigation and a user-friendly interface.

Key Features

- Enables you to build Vola Score and access bigger advances

- Uses Plaid for secure transactions

- Supports over 6000 banks and credit unions

- Alerts you about low balances to eliminate draft overpay or NSF fees

| Pros | Cons |

|---|---|

| On-demand advance loans | Loan limit is only $300 |

| Promotes financial education | Requires a subscription fee of $3 to $29 |

| Zero credit checks for loan qualification | |

| Zero-interest fees |

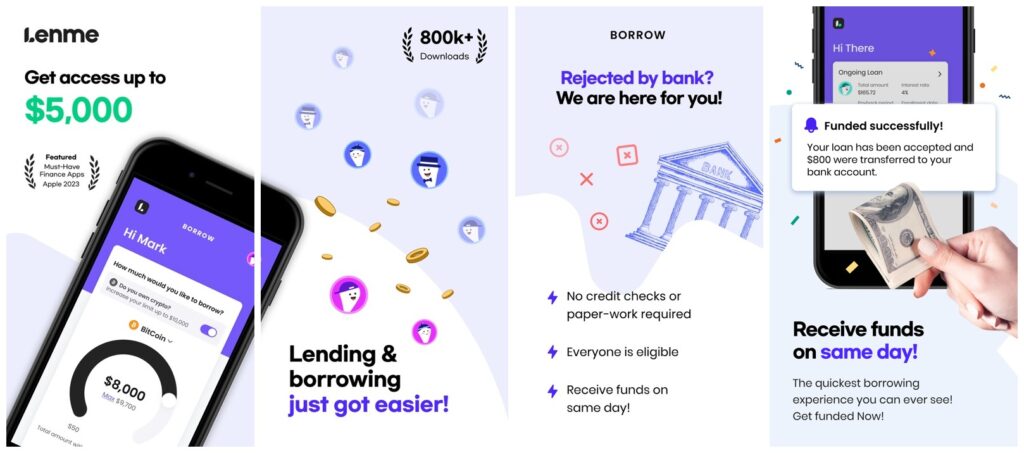

4. Best for Ease of Use: Lenme

Lenme is a peer-to-peer lending app. It excels in its user-friendly interface, transparency, and simplicity. The lending process is straightforward: borrowers request loans, and investors choose which loans to fund.

Although the app offers slightly higher interest rates, the user experience and transparency make it an excellent choice for peer lending solutions. The app has a no origination fees policy, ensuring no hidden loan costs.

The best feature of the app is that your loan can get approved within 24 hours. After approval, the loan gets deposited in your bank account in less than a week.

Comparison with Solo Funds

Lenme offers a higher loan amount ranging up to $5000. While Solo Funds provides a term of 35 days only, on Lenme, you make repayments over six months or longer.

Borrowing a loan on Lenme requires no credit check, with an APR of 11-29 %. Vola Finance caters to a more rounded financial management, while Solo Funds prioritizes short-term financial needs and community collaboration.

Key Features

- User-friendly interface with transparent lending options

- Streamlined peer-to-peer lending experience

- Prioritizes user experience and clarity

- Utilizes loan-matching algorithm to connect borrowers and lenders

| Pros | Cons |

|---|---|

| Claims it takes only three clicks for borrowers or lenders to start | Involves risk of peer-to-peer lending |

| Access loans ranging from $5 to $5000 | Requires users to be financially savvy |

| No credit check and loan approvals within 24 hours | Higher fees as compared to other apps |

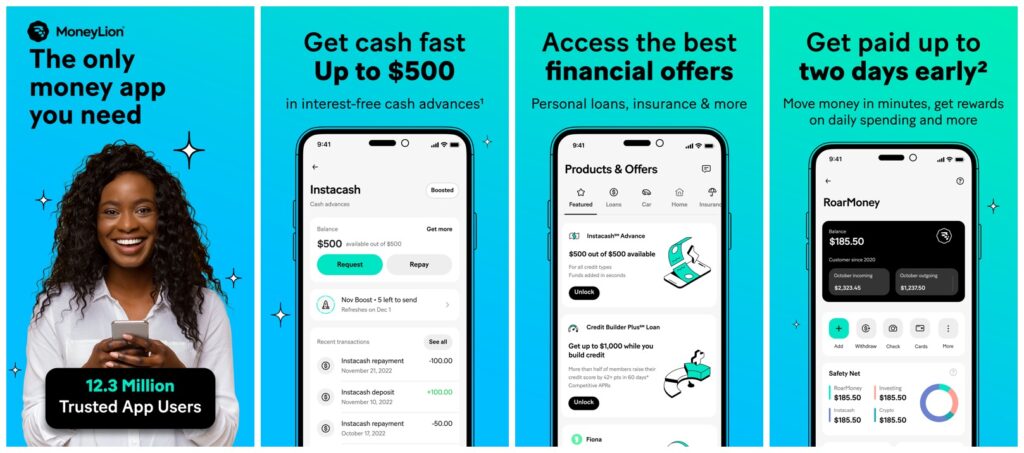

5. Best with 0% APR Cash Advances: MoneyLion

MoneyLion is an outstanding alternative to Solo Funds. The app’s seamless features create a robust platform for borrowing loans. The standout feature of is its 0% APR cash advances.

The app enables you to borrow up to $500, depending on your account activity and income. What sets the app apart is its ability to increase your borrowing limit to $1000. However, this depends on your usage of their products, including its investment account.

You might need a few weeks to become eligible for the maximum advance of $1000. MoneyLion is an excellent app for individuals seeking immediate and long-term financial support.

Comparison with Solo Funds

While Solo Funds emphasizes a community-driven short-term financial platform, MoneyLion has a more comprehensive approach that goes beyond lending.

Solo Funds caters to specific lending needs, but MoneyLion and its alternatives cater to individuals seeking financial tools and guidance.

MoneyLion includes features like credit-building services, reward programs, and tailored financial guidance. However, both apps display a robust lending approach with a user-friendly interface and simplicity of use.

Key Features

- Potential to increase your borrowing limit to $1000

- Features 0% APR cash advances

- Peer-to-peer lending enables direct transactions in the app

- Offers multiple finance features like investing

| Pros | Cons |

|---|---|

| Offers advances up to $1000 | The steep credit-building program costs $19.99 per month |

| Allows extension of repayment date | Extra cash advances of $300 only for members |

| No mandatory fees or overdraft fees | Higher fast-funding fees |

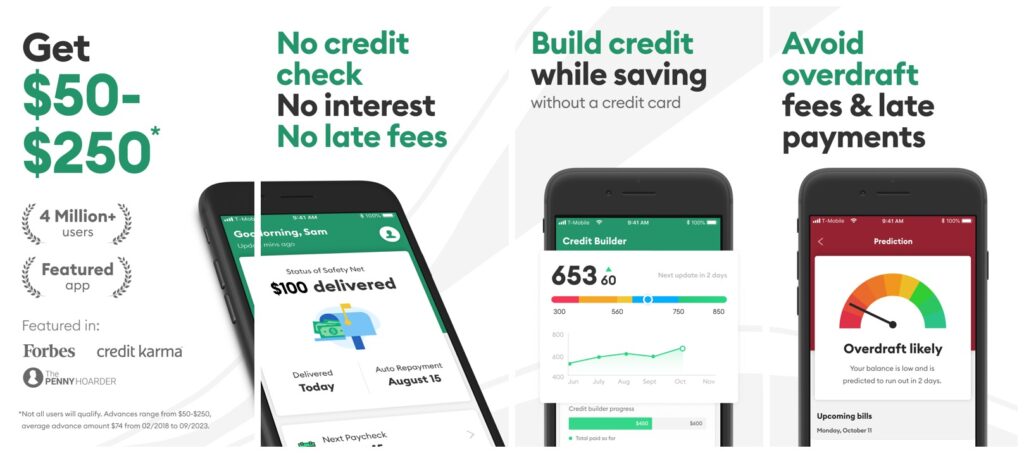

6. Best for No Late Fees: Brigit

Brigit is one of the most popular financial wellness apps. It offers prompt financial aid with free advances on your paycheck. One of the app’s best features is its speedy processing, which takes just about 20 minutes.

The app doesn’t require any credit check, so you can start using the app within minutes. The app features a free and Plus plan.

While the free plan offers financial advice and data on your spending habits, the Plus plan offers extra benefits like overdraft protection.

With the Plus plan, you can get monthly instant cash payments for $9.99. The turnaround time varies based on the fee option. With an instant fee or Premium subscription, your turnaround time will be 1 to 3 business days.

Comparison with Solo Funds

Brigit offers a lower loan amount ranging from $50-250. But, both the apps provide a similar approval period of 1-3 business days.

While Solo Funds has no subscription fee, the Brigit app has a monthly subscription fee ranging from $9.99 to $14.99.

Brigit levies a $0.99 to $3.99 fast-funding fee, while Solo Funds charges a fee of 1.75%. Despite all the differences, both apps focus on offering a user-friendly and reliable platform for lending.

Key Features

- Free advances in just 20 minutes if you have a linked debit card

- Free to use, including budgeting and monitoring features

- Offers automatic overdraft protection

- Provides $1 million in identity theft insurance

| Pros | Cons |

|---|---|

| Get cash up to $250 on the same day of application | High membership fee of $9.99 |

| Enables a better and increased credit score | Doesn’t accept joint checking accounts |

| Offers a separate credit-builder product for advance repayments | No report payments to credit bureaus |

| Requires a qualifying checking account |

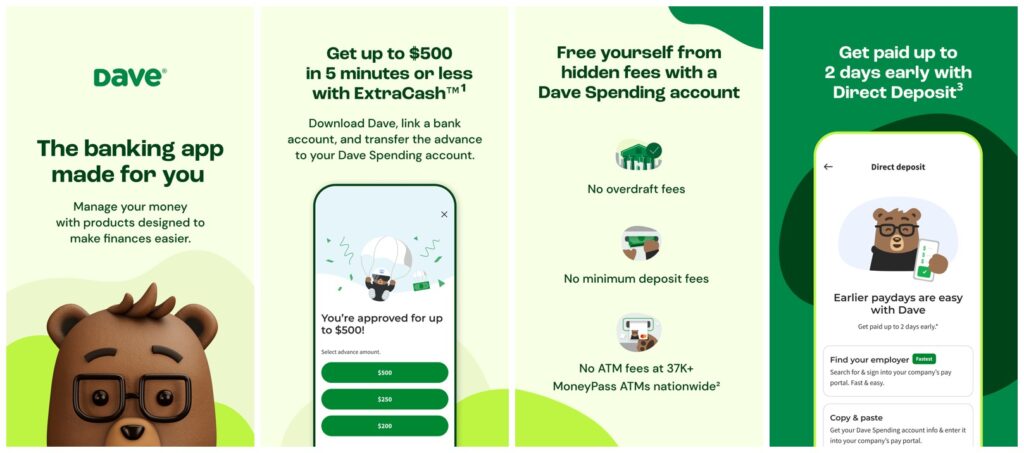

7. Best without Hidden Fees: Dave

Dave is an exceptional alternative to the Solo Funds app. It is more affordable than other apps, with a monthly membership of only $1. The app also features two funding delivery speeds: standard and express.

With the standard delivery, you can receive money within 3 business days, while the express delivery takes only eight hours. However, express delivery requires a fee ranging from $1.99 to $11.99.

Dave features smooth cash advances, and my experience with the app was relatively seamless. You can get loan amounts up to $500 with varied loan terms.

The app typically funds small expenses that cover gas money or similar cash requirements.

Comparison with Solo Funds

Despite their differences, Dave and Solo Funds feature striking similarities. Both apps display an intuitive interface and ease of use. The simple navigation and clear icons enable you to process your loans efficiently.

Another similarity is that both apps have an optional tip feature instead of charging an interest fee on advances. While Solo Funds doesn’t require a monthly fee like Dave, it does have a high late fee.

Key Features

- Offers an opportunity to build credit rating

- Get cash advances up to $250 with no fees

- Provides reliable loans for small expenses

- Access instant funds for emergencies

| Pros | Cons |

|---|---|

| Get an instant loan even with bad credit | Higher fees for same-day funding |

| Find a side hustle through the app | A mandatory subscription fee of $1 |

| Allows you to extend the repayment date | Requires a Dave checking account |

| Caps tips at 25% of your advances |

Wrap Up!

In my experience with the apps, I discovered an impressive user interface, lending and borrowing terms, and instant cash advances.

Solo Funds is an excellent platform for accessing quick cash and getting small loans. However, beware of missed payments, as it can negatively impact your credit score, limit future loans, and result in negative reviews.

Therefore, feel free to explore the platform, but always be vigilant and mindful.

Leave a Reply