Be it cash advances, early payouts, or getting rewards on your spending, MoneyLion has got it all. One of the finest personal finance apps, the app also helps you get personal loans or build a credit score.

However, there are times when it might not be enough or serve well, and you might want to look for alternatives. Luckily, there are a plethora of options and perhaps the reason for confusion.

Not anymore as you’ve come to the right place!

Top 7 Apps Similar To MoneyLion

I have used MoneyLion in my university days. It has been of great help to me whenever I needed some extra funds, particularly toward the end of the month.

To find these alternatives, I and my team collectively tested over 17 cash advance apps on multiple parameters. These include user reviews, authenticity, charges, loan sanction time, credit period, and more.

After in-depth analysis, I have come up with the following 7 options.

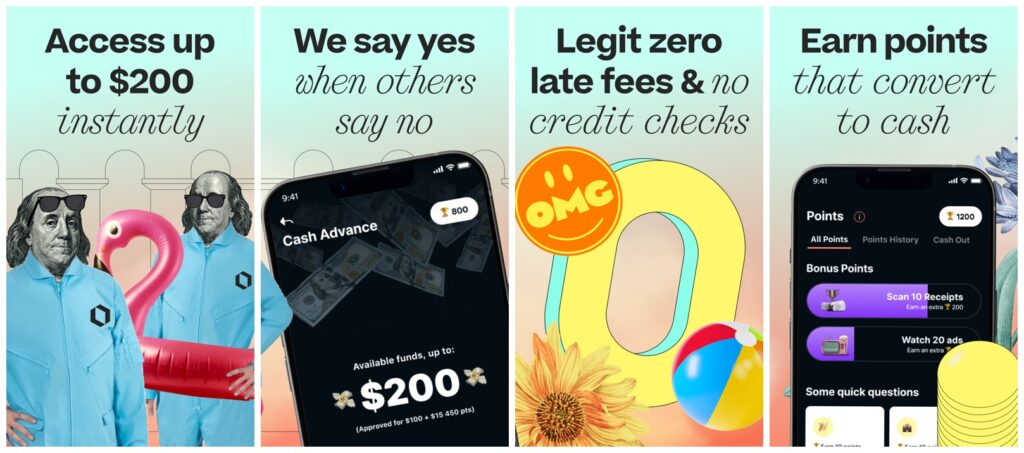

1. Best of All: Klover

Klover is one of the most popular platforms for people who are looking for instant cash advances. The app can pay you up to $200 and does not charge you any additional fees on top.

It is used by over 2 Million people, offers a number of features, such as budgeting and tracking spending.

Getting a loan on Klover is pretty simple. All you need to do is sign up and connect your bank account. You need to have received 3 direct deposits from an employer for three consecutive months to be eligible for advances.

The app’s repayment date is usually on your payday, but you can change it manually. The repayment happens automatically as a charge on your Debit Card or via your bank account.

Comparison with MoneyLion Funds

Klover and MoneyLion are both personal finance apps that help you with multiple finance-related services. Be it taking out personal loans or small cash advances, the apps are good for the task. Here are some similarities and differences between the two:

- MoneyLion provides cash advances up to $500, and Klover up to $200.

- Klover charges a monthly membership fee of $3.99, and MoneyLion’s RoarMoney has a $1 fee.

- Both apps allow you to track your spending and set a budget.

Key Features

- Earn encashable points by performing simple tasks

- Stand a chance to win between $20 to $100 every day

- Create budgets, saving goals, and track expenses

- Track your credit score from the Klover app

- Helps build savings by investing change money

| Pros | Cons |

|---|---|

| Points that you earn help you boost cash advance limits | The repayment process sometimes takes time to process |

| Does not charge any late fees on cash advances | Does not offer a big cash advance |

| Easy-to-use app with a good User Interface |

For more closer details, you may check out the Klover reviews. If needed, you can also try other apps like Klover with similar requirements and advances.

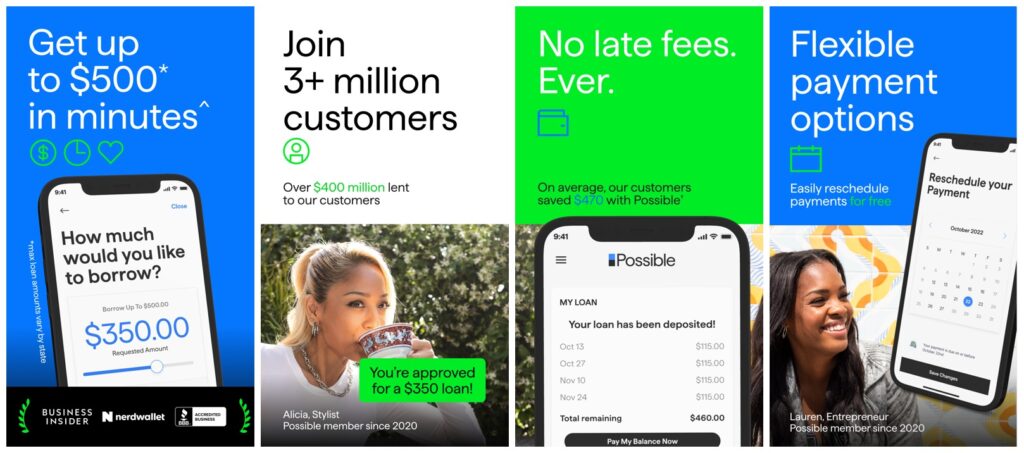

2. Best Runner Up: Possible Finance

An app that allows you to borrow up to $500 in a matter of minutes, Possible Finance is an excellent option trusted by over 3 Million users!

The app does not charge any late fees and provides its users with flexible payment methods. It is the perfect app to try out when you are in need of a financial boost or if you are short of funds at the end of the month.

One of my team members has been using Possible Finance almost since the time it came out, and have used their advance cash facility on a regular basis.

The app allows you to pay back your advances in up to four instalments, which is comfortable if you want a large advance but are unable to pay back all of it in one go next month.

Another aspect where this app really came to your rescue was when you want to build a credit score after taking a loan, and the deposits that came from here went straight to the loan repayment!

Comparison with MoneyLion Funds

There are many similarities between MoneyLion and Possible Finance. Prima Facie, both these apps help you with your personal finances and help you improve yours.

- MoneyLion is supported in 23 US states, while Possible Finance works only in 21.

- Both apps support borrowing up to $500 in cash advances.

- Possible Finance deposits the amount to you as quickly as 1 business day, MoneyLion generally takes longer or charges an instant deposit fee.

Key Features

- Offers up to $500 in cash advances

- A long repayment period ensures you’re not short of cash again

- Charges no late fees or penalty

- Helps build a credit history

- Supports 21 US states

| Pros | Cons |

|---|---|

| Does not need a credit check to approve advance cash | Impacts your credit score if you don’t repay on time |

| Supports repayments in 4 installations over 8 weeks | Customer support is somewhat slow and takes multiple days to get back |

| One of the fastest apps when it comes to processing advance cash |

3. Best with AI Integration: Cleo

Cleo is among my favorite picks when it comes to personal finance and money management. The app uses smart Artificial Intelligence integration to provide you with smarter financial support.

Cleo helps you do a lot of things. Not only does it give you cash advances up to $250, but it can also help you work on your credit score and improve your credit rating over time.

The app also goes through your financial records and gives you an insight into your bank balance, as well as a breakdown of your spending. However, my favorite part about this app is the intelligent chatbot.

You can straight-up ask it questions about your finances like “Cleo, how much did I spend on food this week” and it will go through your statements and tell you. The app also helps you set smart saving goals also shows you all the bills that are coming up.

While advance cash is one feature that I use pretty frequently, there’s just so much more to this app.

Comparison with MoneyLion Funds

When I compare MoneyLion to Cleo, there is one clear result that I see. MoneyLion might be a superior app when it comes to providing advance cash, but when it comes to looking at the larger picture of personal finance, Cleo takes the cake.

Here’s a look at how these two pan out:

- MoneyLion supports cash advances up to $500, while Cleo supports up to $250 in advances.

- Cleo requires a $5.99 monthly fee to access advances, MoneyLion’s RoarMoney costs $1.

- Cleo takes 3 to 4 days to transfer the advance funds, and MoneyLion takes up to 5. Both can do it quicker for an additional fee.

Key Features

- Cleo connects with your bank account to provide detailed financial insights

- The app uses a smart AI-based bot that you can chat with about your finances

- Provides a cash advance of up to $250

- Charges no APR interest and no late fees

- Cleo helps you set your monthly budget and tracks your expenses for you

| Pros | Cons |

|---|---|

| One of the smartest personal finance apps out there | Monthly membership fees on the higher side |

| Excellent user interface and very easy to use | Takes up to 4 days to transfer funds or charges fees for instant transfer |

| Does not charge an APR interest on cash advances |

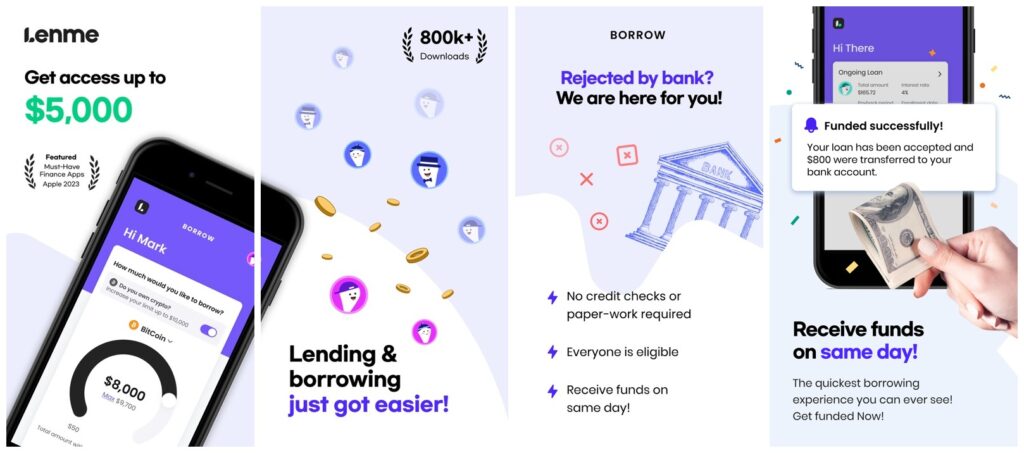

4. Best for Versatility: Lenme

Lenme is a unique money-lending app because, unlike other platforms here that give out cash advances and loans from their own end, it uses a peer-to-peer lending system. Users on this app can be divided into two broad groups – lenders and borrowers.

Lenders can set their own terms for lending, including the interest rate and return period they are comfortable with, and the borrowers can choose the kind of deal that suits them the best.

Borrowers are allowed to borrow up to $5000. This $5000 limit starts off low but builds over time.

In a market where people are always looking to diversify their investment portfolio, Lenme comes in as a great option. Investments on Lenme are smarter because you’re investing not in a stock or a fund but in humans.

It is a safe lending platform that has multiple layers of verification systems that include the SSN and a government ID.

During the app testing, I borrowed money from the app, and what surprised me was how quick they were in transferring funds.

Comparison with MoneyLion Funds

When you compare Lenme and MoneyLion, you are essentially looking at two very different apps with two different lending mechanisms.

MoneyLion is a traditional lending app where the app is itself lending you the money, while Lenme has a completely different p2p-based lending system where other users lend you the money.

- MoneyLion does not charge any interest on the advances, but the borrowings on Lenme will usually have an interest rate attached to them.

- In MoneyLion, borrowers take advances and return them to the app, but in Lenme, borrowers take loans from lenders and repay them.

- If you are eligible to get advances from MoneyLion, you will get it. However, in Lenme, there is no guarantee that you will find a lender who will lend you.

Key Features

- Allows borrowers to lend up to $5000

- Lenders can set their own interest rate and return terms

- Takes between 1 to 3 days to transfer funds

- Get a $40 bonus on referring people to Lenme

- Also supports larger loans backed by crypto wallets

| Pros | Cons |

|---|---|

| Allows investors to diversify their portfolios | Users have reported lot of bugs in the app, especially during accepting offers |

| Strong verification mechanism: SSN, Government ID, and Bank Account | Customer support isn’t responsive and can take many days to get back |

| No credit score or paperwork required to borrow money |

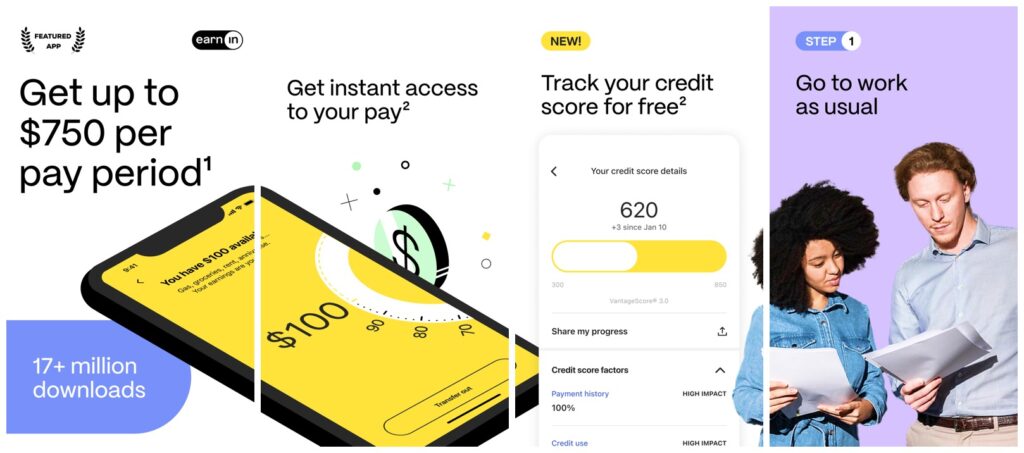

5. Best for Advance Paycheck: EarnIn

You work every day to get that paycheck at the month end. However, emergencies can arise at any time, and you may need some cash. EarnIn allows you to cash out on your earned income before the paycheck rolls out.

You can borrow up to $100 per day and up to $750 per paycheck from the app. At the end of the month, EarnIn deducts the amount that you have cashed out from your bank account once your paycheck is credited.

I found this app to be pretty helpful during a period of medical emergencies where I had been spending a little extra to cover up for my medicines and health checkups. Earnin had come as a great help.

The whole process was pretty smooth and the funds came to me between 1 to 2 days. This is pretty quick compared to other MoneyLion competitors.

Furthermore, here I am not taking a loan from anyone as this money is coming from my own income.

Comparison with MoneyLion Funds

While both MoneyLion and EarnIn help you get some cash when you want it, there are differences between these two apps. MoneyLion lends you money from its own end, while EarnIn is essentially giving you an early payday from the money that you have earned in your regular job.

Here are some comparisons between these two apps:

- MoneyLion supports advance cash up to $500, and EarnIn allows you to borrow $750 per paycheck.

- EarnIn transfers the funds in 1-2 days, while MoneyLion can take up to 5. Both of them have a paid service for instant transfers.

- Both these apps do not charge you any interest on the amount you take from them.

Key Features

- EarnIn supports ‘Lightning Speed Transfers’ for instant transfers at a fee

- The app can lend you up to $750 per paycheck period

- Allows you to track and monitor your credit score

- The ‘Balance Shield’ feature in EarnIn alerts you when your bank balance is low

- No credit checks are required to get money from EarnIn

| Pros | Cons |

|---|---|

| Not a loan or cash advance, you’re getting your own money | Allows only $100 per day and $750 per paycheck |

| Quick live chat support available round the clock | Supports only a limited set of banks |

| EarnIn does not sell your data to third parties |

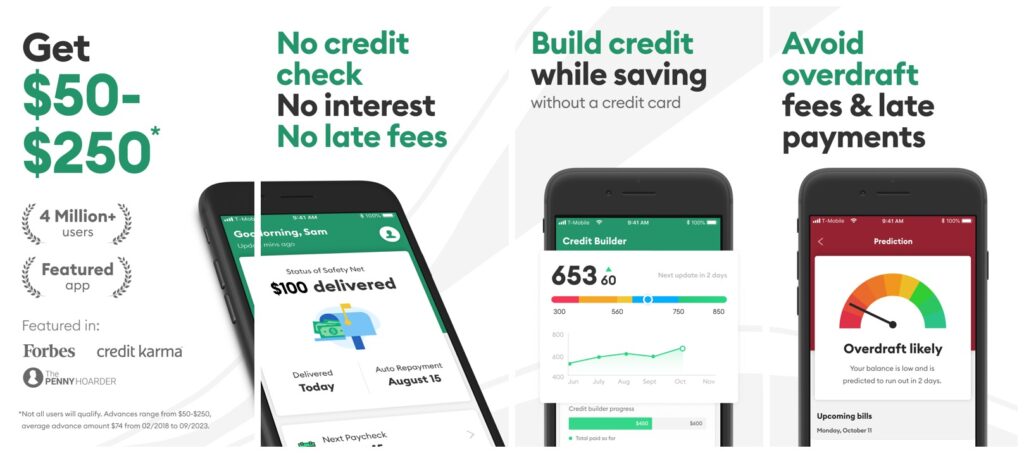

6. Best for Budgeting: Brigit

There comes a time when we all need a little boost in our monthly finances. Brigit is a very helpful app in these situations. The app offers cash advances up to $250, which can come in pretty handy, especially towards the last week before the salary arrives.

The app is not just about cash advances, because it can also help you make smarter financial choices by budgeting better. Even users without a Brigit Plus subscription can request cash advances over email.

Those with Brigit Plus ($9.99/month) can make cash advance requests through the app, as well as get access to advanced tools for budgeting and credit reporting.

There’s a Brigit Premium ($14.99/month) as well, which helps you build your credit score. I found signing up on the app to be a pretty easy process. The UI is simple and easy to navigate. I also found their minimum requirements to be pretty chill.

Comparison with MoneyLion Funds

Brigit and MoneyLion are quite similar in more aspects than they are different. Both these apps offer cash advances – and that is their core. However, Brigit goes a step ahead and offers a number of other financial solutions too.

Here’s a closer look at what makes the two similar but also different from each other:

- MoneyLion supports cash advances up to $500, Brigit supports up to $250.

- Both MoneyLion and Brigit come with an option for instant transfers at an additional fee.

- Brigit offers smart financial services such as monitoring your bank accounts and sending alerts when your balance runs low. MoneyLion doesn’t do anything like that.

Key Features

- Offers cash advances ranging between $50-250

- Helps build your credit score with Brigit Credit Builder

- No credit checks or security deposits needed to get advances

- Provides credit builder loans at 0% APR interest

- Brigit can also help you find remote work and part-time gigs

| Pros | Cons |

|---|---|

| Avoid overdrafts with automatic advances on Brigit | Lots of fees and charges – pretty expensive |

| Extend your due date if you are unable to pay on time | Doesn’t provide live chat or on-call customer support |

| Excellent UI – very smooth app to navigate through |

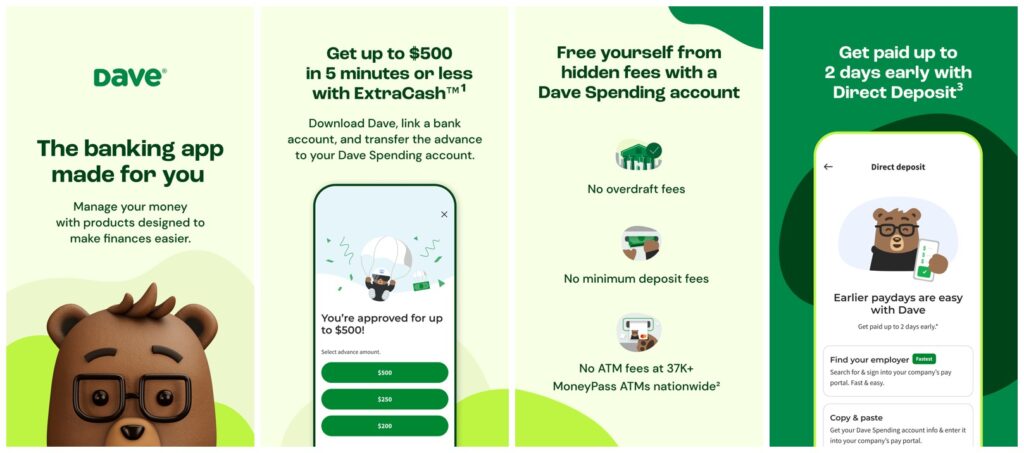

7. Best User-Friendly: Dave

Dave is an all-round banking app that offers you cash advances up to $500, but does much more than just that. For instance, it helps you track your spending, as well as save more money by rounding up your purchases and giving you interest on these savings.

Dave also sends out surveys from time to time which help you make a little extra on the side. Another feature that I find pretty cool is the ‘side hustle board’ which lets you find gigs and part-time jobs just like apps like Instawork.

Dave also issues a MasterCard-backed Debit Card to its users. However, the feature you may appreciate the most is the one that gives cash advances.

This is the ‘ExtraCash’ feature, and it can be availed without any credit checks, interest, or late fees. Dave takes about 3 days to deliver the funds to you or charges a small fee for instant transfers.

Comparison with MoneyLion Funds

Dave and MoneyLion work on largely the same principles. Both apps lend out cash advances to people who want them. However, Dave goes a little beyond that and also helps you with some other finance-related facilities.

Here’s what’s common between the two and what’s different:

- Dave processes funds in about 3 days while MoneyLion takes up to 5, both apps can process it faster if you are willing to pay an extra processing fee.

- Dave can also help you make more money by finding a part-time job or a freelance gig using the ‘side hustle board’. This is something that MoneyLion does not do.

- Both Dave and MoneyLion can issue you debit cards backed by MasterCard.

Key Features

- Offers cash advances of up to $500

- Advances can be returned by the next Payday

- Allows you to set goals and save money accordingly for different goals

- Helps you find part-time jobs and gigs to make extra money

- Issues a MasterCard Debit Card

| Pros | Cons |

|---|---|

| Repayment due dates for some users are just the Friday after the advance | The instant transfer fee is high on high advance amounts |

| The side hustle feature helps find extra sources of income | Repayment due dates for some users is just the Friday after the advance |

| Dave Debit Card gets you cash-backs and additional rewards |

Frequently Asked Questions

Yes, MoneyLion is an authentic app that gives you cash advances up to $500 with ease. It is among one of the most trusted lending apps, with over 12 million users.

If you do not pay back MoneyLion, you will be declared a defaulter and a debt collection agency will get involved. You may also get a legal notice after that.

You can contact MoneyLion customer support by heading to the support section of their website. You can reach out to them over live chat, email, or even on a phone call.

Wrap Up!

I hope this list helps you fulfil your urgent money needs. Emergencies can happen at any time, and any of us can fall short of funds. However, there is no need to panic as these MoneyLion alternatives provide short-term loans which can be of big help.

Leave a Reply