Cash emergencies can happen at any time. For most people, it tends to happen more toward the end of the month. However, gone are the days to stress about these things as Cleo exists.

However, it limits cash advances to only $250 which may not be sufficient for you. Or it may have become unserviceable in your area. And that’s why you’re looking for alternatives to Cleo, right?

No worries, my team combined have tried 16 cash advance apps similar to Cleo. We tested them against several parameters like amounts offered, disbursement time, terms & conditions, charges, privacy, and ease of repayment.

I eliminated the bad-rated, high charges, and low-key platforms and finally came up with the top 7 options. So, without further ado, let’s dig in!

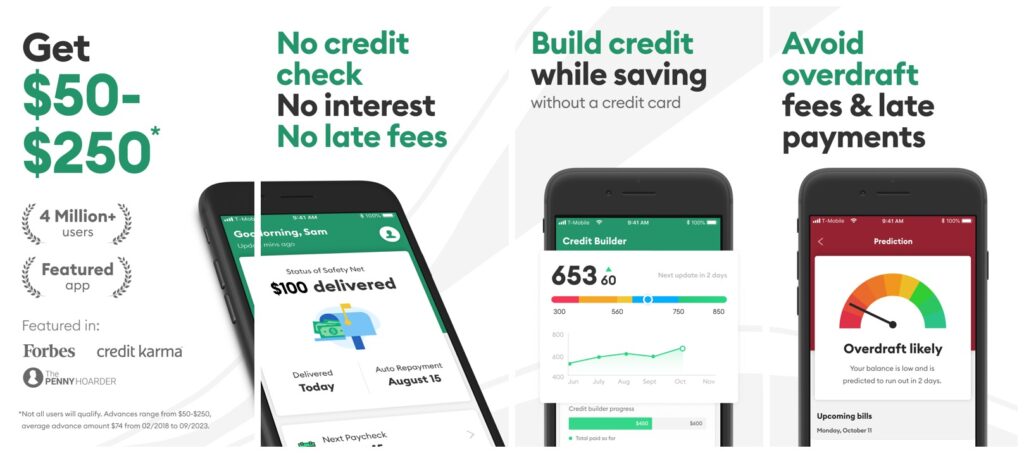

1. Brigit

Brigit is an app that is pretty similar to Cleo, as it gives you a cash advance of $250 upon need. What really impressed me the first time I tried it out was just how easy it was to sign up and begin using the app.

Key Features

- Get up to $250 in cash advances

- Helps build credit scores as well as boosts savings

- Helps you budget better and track your bills and expenses

- Dedicated in-app job board to help you find new work opportunities

- No credit checks are needed and easy sign-up

Brigit signs you up in under 2 minutes and doesn’t even run a credit check on you. You need a Brigit Plus subscription to get in-app cash advances.

While offering cash advances is one of the primary features it is known for, Brigit is also seen as a tool for saving up money and building credit.

The app incentivizes monthly savings of small amounts, which helps you build a strong credit score over a long period. It starts with as little as $1 per month for 24 months, and upon maturity, you get the full amount back.

Much like Cleo, Brigit too has a feature that helps you budget better. This is the Brigit Finance Helper tool. This feature is available under Brigit’s free plan and can be used by all users. It allows you to keep track of your bills as well as understand your spending habits better.

Another cool feature is called ‘Earn and Save’. The app allows you to earn some extra cash by finding gigs that suit your skillset. There is a dedicated job board within the app which helps you find full-time and part-time work opportunities.

Things I didn’t like

- A Brigit Plus subscription is required for many basic activities.

- Non-Plus users need to make cash advance requests over the mail.

Overall, Brigit is an excellent cash advances app that doesn’t limit itself to just offering advances. The app goes above and beyond the basics and delivers many other important features such as a credit builder, a job board, a budget tracker, etc.

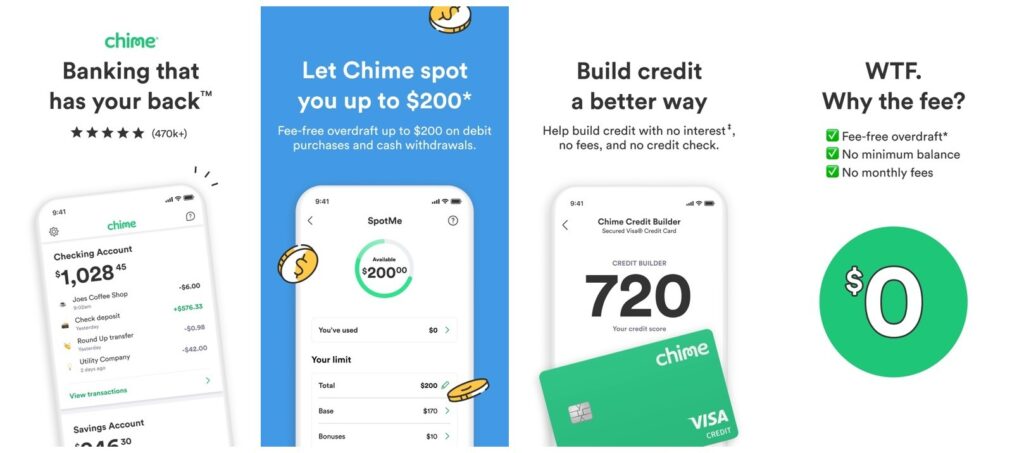

2. Chime

Unlike other apps, Chime doesn’t really offer a ‘cash advance’. However, it offers extra cash on-demand (up to $200) via the SpotMe feature. It is an overdraft without any additional fees and is available only to users who have a Chime Debit Card, along with a checking account that carries $200 worth of monthly deposits.

Key Features

- Chime’s SpotMe overdraft supports $20-$200 in overdraft payments

- Zero additional fees on overdrafts

- Chime offers a free Visa Debit Card to its users

- Credit Builder feature to help improve your FICO score

- ‘Boost’ feature lets you boost your friends’ credit limits

- Allows you to transfer money to the Cash app

The SpotMe is free and does not come at any fee. However, while you are returning your money to Chime, you can optionally choose to give a tip along with that.

Chime claims that it is thanks to these tips that they can keep the service free of cost. Chime charges $0 as an overdraft fee vs the $30 average of most traditional banks.

Its Visa Debit Card on which you can use the SpotMe overdraft feature is also free of cost and doesn’t have a minimum balance requirement. The debit card can be connected straight to your phone’s wallet app for easier digital access.

Chime has another interesting feature in the app called ‘Boost’, where you can boost your friends’ credit limits by $5. People can send and receive multiple boosts. This is a very interesting feature which sets it apart from Cleo.

Things I didn’t like

- Customer service is very slow.

- Minimum $20 limit on SpotMe transactions.

All in all, Chime is an excellent app like Cleo that helps you get some extra funds in times of need. The app does most of it without any additional fees and costs and depends solely on the goodness of those who add tips to function freely.

I have also found Chime to be a very good option for building some credit before heading to the banks for a loan. Do take a look at it.

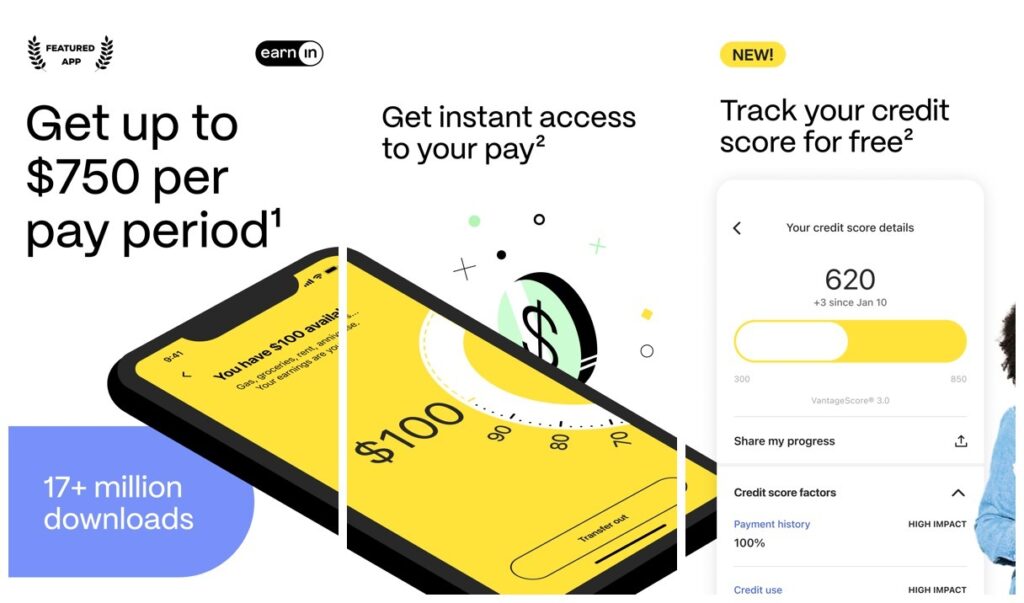

3. Earnin

While my salary usually arrives on the 30th or the 31st of every month, I often find myself in a cash crunch by the 20th. In times like these, I turn to Earnin. The app helps me withdraw up to $100 a day from my own earned money which is yet to reach my account. The app supports withdrawing up to $750 this way.

Key Features

- Get advances up to $100 per day and $750 per paycheck

- Cash taken in advance gets deducted from next paycheck

- Cash advances reach your bank instantly for a fee

- Track your bank balance and credit score and get notified of changes

- 24/7 support for any help

With Earnin, the best part is that you are not taking any loans. It is coming from the paycheck that you are yet to receive and will be deducted directly from your account. The app charges no interest on the money you’ve taken in advance and doesn’t even put you through a credit check process.

Earnin gives you two options to receive these advance funds — you can either choose to get them instantly (at an additional fee) or get them for no additional cost between 1-3 days after requesting.

At the moment, Earnin works with most major banks in the US including but not limited to Bank of America, Wells Fargo, Chase, and Capital One.

The app also helps you take better control over your financial stability and notifies you when your bank balance hits a low. Lastly, Earnin also lets you track your credit score from within the app, and can also notify you when your credit score changes.

Things I Didn’t Like

- Supports a limited number of banks

- The borrowing limit tends to fluctuate quite a bit

To sum up, Earnin is an excellent app that lets you claim some of the money you’ve earned before it is credited into your account. It is great for emergencies.

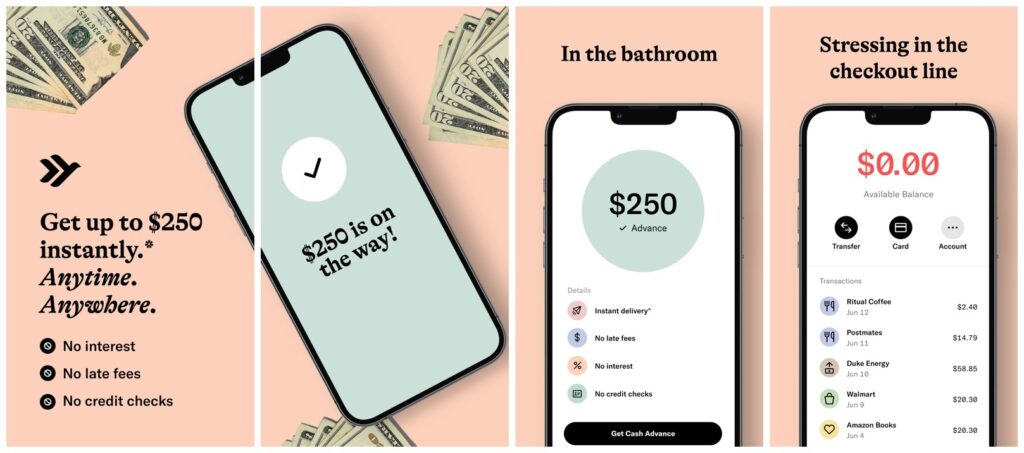

4. Empower

When I first installed Empower, I had no idea the app would impress me so much. It supports cash advances between $10 to $250, but that’s not even the best thing about it.

What really attracted me to stay here longer was the incredible UI that the developers have come up with. This is by far the most visually appealing Cleo alternative.

Key Features

- Helps you borrow between $10 to $250 instantly, up to $1000 over time

- The savings feature deducts a set amount of funds from your account every week

- Track your spending and get insights into where your money was spent

- Monitor your credit score and get notified of changes

- Supports instant payment of cash advances at an additional fee

On Empower, you can take up to $250 in cash advances without any interest, late fees, or credit checks! While this is one of the biggest highlights here, another key feature in Empower is that of ‘Thrive’. Thrive helps you build your credit history and helps you borrow up to $1000 over time.

While many cash advance apps promote reckless spending, Empower actually promotes savings. The app has a feature where you can set a weekly limit which is automatically deducted from your account and put into a savings account. This is an excellent feature that I have been using since day 1 of using the app.

People who want to keep a close tab on their credit score can also use this app to their benefit as Empower allows you to monitor your score and notifies you when it changes.

The credit score isn’t the only thing that you can monitor, it also helps you track your spending habits and gives you summaries of how your money was spent.

Things I Didn’t Like

- Charges extra for instant transfer of cash advances

- $8 subscription fee per month

So, is Empower worth the $8 you pay every month to be a member? I would absolutely say so. The app provides you with an excellent opportunity to get cash advances and is perhaps the easiest of the lot on this list to use.

Empower’s savings feature is also something that I really love and use frequently, especially when I need to save to plan for a future event.

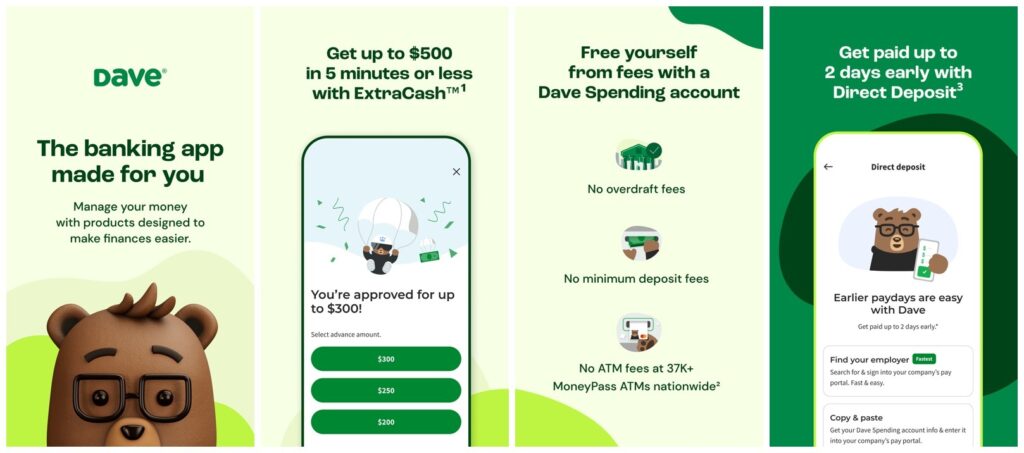

5. Dave

The friendly bear on the Dave app isn’t a deception. This app is actually quite user-friendly and helpful, especially when you’re left short of funds towards the end of the month. Dave helps you get a cash advance of up to $500 with their ‘ExtraCash’ feature.

You can sign up for ExtraCash in just a matter of minutes and you don’t even need to go through a credit check.

Key Features

- ExtraCash feature helps you get cash advances up to $500

- Dave Spending Account yields you 4% interest on storing funds

- Dave’s digital MasterCard Debit Card can be used on wallet apps

- Spending Account helps you get your paycheck up to 2 days earlier

- Use the Side Hustle feature to find part-time gigs on the Dave

Apart from the ExtraCash feature, Dave also has a number of other offerings, including a Dave Spending account (which yields you 4% interest).

The account also gives you access to a digital Mastercard Debit Card that can be used along with Google Pay and Apple Wallet. Shopping with this Debit Card grants you access to some exclusive deals and discounts too.

Dave Spending also gives you access to Dave’s budgeting features where you can see all your finances organized in one place.

You can also set up a ‘Goal Account’, which allows you to add funds and create small savings deposits to work toward certain goals. This can be travel, big-ticket purchases, etc. There are no fees or minimum deposit limits here.

Lastly, another Dave feature that I want to address here is called ‘Side Hustle’. This feature on the Dave app helps you gain access to gigs, part-time jobs, work-from-home jobs, temporary jobs, etc. which help you make some extra money on the side!

I found a great delivery gig over here last summer. Dave charges a $1 monthly subscription for some premium features.

Things I Didn’t Like

- Charges a fee for instant transfer of funds

- The support team can take quite a while to respond

All said and done, at a subscription fee of $1, Dave is totally worth it. The debit card works really well and gives you access to some special perks and deals.

The job board there helps you find regular gigs, and the ExtraCash feature is of course the mainstay of the app. I find Dave to have multiple advantages over Cleo in terms of these diverse features.

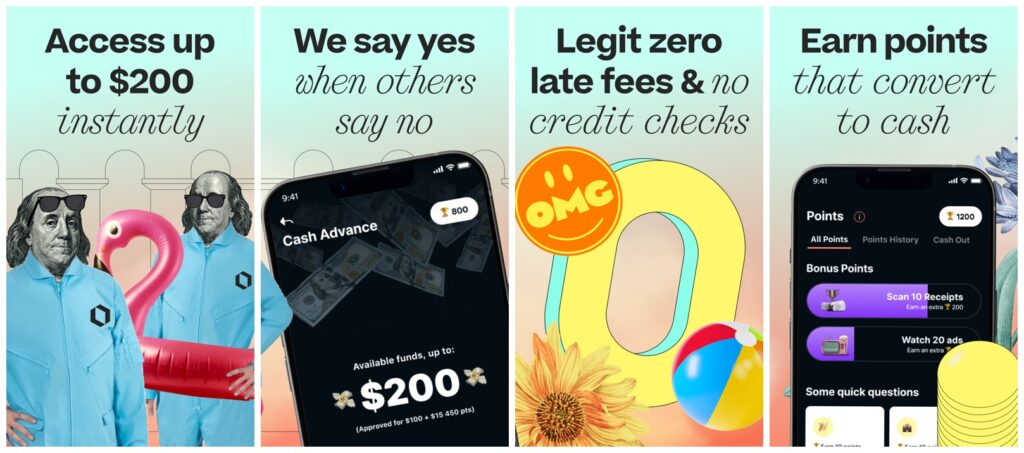

6. Klover

One app that I got on pretty recently is Klover. I have found it to suit all my needs, especially when it comes to quick transfers. It allows cash advances up to $200 and does not charge any interest, late fees, or charges on top of it. And it doesn’t even run a credit check on you.

The app has gamified many things here, including distributing points and setting up mini-games that help you win daily rewards.

The app rewards you with points for completing certain tasks, and these points can later be redeemed for rewards. Not as high as gift cards earning apps though.

The app also has a daily lottery where one person can win up to $100 every day, and 5 other people get $20 each. It is small things like these that make Klover pretty intriguing. But it has a monthly subscription that costs $3.99, which I feel is small for the kind of services the app offers you.

Key Features

- Get cash advances up to $200

- Track your spending habits and set budgets

- Score points and exchange them for rewards

- Win up to $100 on daily games

- Track your credit score

Things I Didn’t Like

- $3.99 monthly membership fees

- Makes random deductions from users’ bank accounts

While Klover is one of the better apps out there, and one of my most recent discoveries, it has quickly become my favorite. The app can process funds straight into my account much faster compared to its competitors.

However, many users have told me that Klover can make random deductions from your account without any warning so maybe keep an eye out for that. So, you might even look for better alternatives.

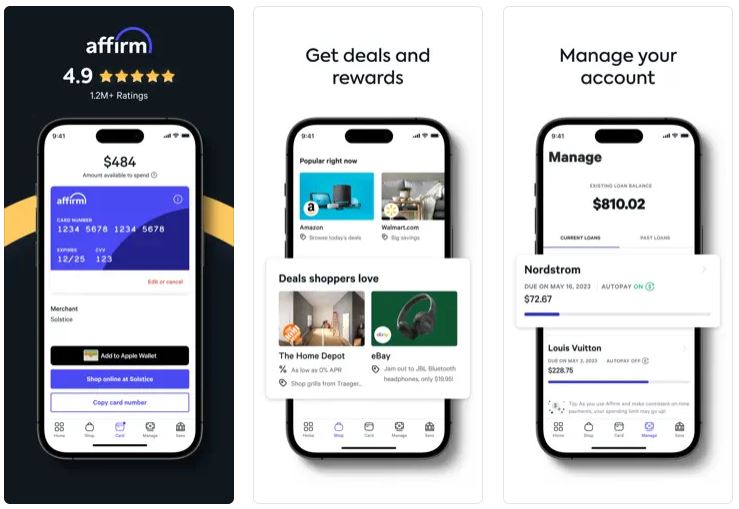

7. Affirm

While all the other apps on my list have been those that focus on cash advances, Affirm stands apart from the rest. This is a BNPL (Buy Now, Pay Later) app that helps you shop in four instalments.

Key Features

- Lets you pay for objects in four installments with 0% interest and no fees

- You can choose to pay monthly installments at 0-36% interest rates

- Allows you to purchase and split any payment up to $3000

- Shows all payments and total amounts upfront before the purchase

- You can also get an Affirm Debit Card to use at stores

I find Affirm to be extremely helpful especially when someone is running short of funds but needs to make an important purchase.

Using Affirm, you can buy anything by paying only 25% of the price and paying the other three instalments every 15 days over the next 45 days.

You can also choose a monthly payment system where you will be charged an interest rate that varies between 0 to 36% APR. However, there is no interest charged on the four-part payment.

Affirm has teamed up with some of the biggest names in the US markets such as Amazon, Walmart, eBay, and Home Depot for an easy shopping experience. The four-part payment comes at no extra charges and with no hidden fees.

Affirm lets you buy anything between $100 to $3000 and split it into instalments of four or monthly payments. The best part about this is that the app tells you up-front about the total amount you will be paying as well as the instalment amount. You can make an informed choice based on that.

Things I Didn’t Like

- Very high interest rates touching 36%

- Can sometimes restrict small purchases

Affirm is an excellent app that you must try out if you are making big-ticket purchases but do not wish to make a big payment in one go. The app can be pretty helpful especially if you want to spend cautiously but still have to buy things. With 0% interest rates, this is a pretty neat platform to use.

Frequently Asked Questions

Most apps on this list support cash advances up to $200. Brigit, Chime, and Empower are three such apps that help you borrow cash advances of $200 or more with ease.

From this list, Empower and Dave work well with Chime. They are both apps similar to Cleo and can provide you with on-demand cash advances.

Cash advance apps send you money when you request it, and deduct it from your account once you get the paycheck from your employer, or at regular fixed dates.

Wrap Up!

Cleo is an excellent app that helps you on multiple fronts: it helps you manage your funds, as well as gives you cash advances as and when you need them. However, one app is never enough and this is the reason I have come up with this list.

I personally love to use Empower and Earnin and get very good results together. I hope you too find a combination that works best for you!

Leave a Reply