Money struggles can pop up when you least expect them. Are you in need of extra cash to cover an unexpected expense, such as a medical bill or car repair? The Klover app can help you with credit of up to $200.

However, if it is not serviceable in your case, there are plenty of alternatives. But this creates a problem. Trying each one to determine whether it is legit can result in multiple credit inquiries, which can harm your credit score.

No worries, I’ve done all the research so that you don’t have to!

Top 12 Apps Similar To Klover [Android & iOS]

My team has collectively tried 20 different cash advance apps. They were chosen based on user reviews and the high cash amounts offered. We evaluated them for different parameters such as fees charged, time taken to sanction the loan amount, payback time, etc.

After in-depth analysis, I’ve finalised the below-listed options:

| App Name | Maximum Cash Advance Amount | Charges | Payback Time |

|---|---|---|---|

| EarnIn | $100/day up to $750 a month | No Mandatory Fees | Next Payday |

| Dave | $500 | $1 subscription | Next Payday |

| Chime SpotMe | $200 | No Fees | Automatic Deduction from Chime |

| Cleo | $250 | Subscription; Variable | Autopay |

| Albert | $250 | No Fees | 10 to 30 Days |

| Brigit | $250 | $9.99 Monthly | Next Payday |

| FloatMe | $50 | $1.99 | Next Payday |

| MoneyLion | $500 | No Fees | Next Payday |

| Even | 50% of earned wages | $8 per month | Next Payday |

| DailyPay | Earned Wages | No Fees | Next Payday |

| Beem | Up to $1000 | Free as well as Paid plans | Automatic Withdrawal |

| Empower | $250 | $8 Monthly | Autopay |

1. EarnIn

EarnIn works on a simple funda — it takes into account your monthly earnings and gives you up to $100 per day, depending on your salary.

Once you are paid, it auto-deducts the amount from your account. You can withdraw a maximum of up to $750 per pay period from the app. All you need is a regular job, a US-based cell phone number, and to be at least 18 years of age.

Here are its key features:

- No fees on regular cash advances

- Allows you to track your credit score

- Provides instant ‘lightning speed’ transfers for additional fees

- Provides 24 x 7 customer support

The EarnIn app is available across the US, as well as US territories. This gives you wider access – no matter where you are in the country, you can still use it.

One of the key limitations, however, is that if you wish to take benefit of the cash advances on EarnIn, you need to have a full-time job with regular paychecks coming your way.

This makes it awkward for freelancers or self-employed users. Also, not all banks support the lightning speed feature. Overall, this is the closest alternative to the Klover app.

2. Dave

The bear on the Dave icon is a rather comforting and friendly sight. The app is more than just a cash advance app, as it is an all-round banking solution.

The ‘ExtraCash’ feature on Dave gives you a $500 advance without any extra fees (though you need to get a $1/month subscription).

What gives Dave a unique advantage is that you can use the ‘ExtraCash’ feature on the app to store some spare funds which you can use at a time of emergency.

Key features:

- No credit checks required

- You can use the advance right away, there are no waiting periods

- No late fees or interest is charged

- The app also helps you with budgeting as well as getting side-gigs for extra money

The app is available all over the US for the ExtraCash feature. Their Mastercard Debit card can be used internationally (with foreign transaction fees applicable).

Dave is a great app for cash advances, but the $1 subscription fee might be a bummer for some users. Furthermore, as a banking app, Dave lacks the ability to allow its users to create joint accounts.

Dave’s list of qualifications to get cash advances is pretty strict compared to some other names in the business so you might want to watch out for that as well.

3. Chime

Chime is a banking app that supports multiple other banking apps on its platform. However, when it comes to cash advances, the feature you are probably looking for is Chime SpotMe.

It provides a no-fee overdraft facility of up to $250 and is a savior when it comes to urgent needs of funds.

Key Features:

- No fees for using the feature – tips are optional

- ‘Boost’ feature allows you to boost your friends and increase their credit limits

- No overdraft fees are charged as well – deductions are made from the next paycheck

- You can use the advance cash directly via the Chime Visa Debit Card

- You can remove Apple Cash from the wallet.

Chime works across all US states and territories. Much like Dave, its Visa card can function even in countries other than the US, but you will be charged a fee for international transactions.

SpotMe puts you in a spot in case you need a small amount. The minimum amount that you can borrow from the app is fixed at $20.

Another thing about Chime that you need to know is that SpotMe is just a part of the Chime ecosystem, where banking is the core facility. You might have to navigate through quite a bit to access advance cash.

4. Cleo

Everything’s about AI these days, so how can a cash advance app resist that? Cleo comes to you with an AI-based solution for managing your finances.

While it does provide a cash advance to you when you need it, it even analyzes your accounts and spending and gives you an AI-generated report on your spending trends and habits.

Below are its key features:

- The app provides up to $250 with no credit checks or interest

- Cleo allows you to improve your credit score without owning a credit card

- In case you miss a deposit, you don’t have to fear about a late fee

- Cleo also comes with several saving options and budget goals

Location isn’t a problem when it comes to Cleo, as it works all over the US. However, you might need to take some caution when it comes to your banks.

However, if the bank in which you have an account is not listed on Cleo, you will not be able to get these cash advances.

Another key limitation of Cleo is apparent when you look at the pricing structure. There are two membership models – Cleo Plus and Cleo Builder.

The cheaper of the two will still cost you about $5.99 a month, while Builder is priced at $14.99 a month. Lastly, you might also want to keep in mind that this app isn’t backed by a federal bank.

5. Albert

Albert provides you with a cash advance of $250, which is $50 better than Klover – proving why it is a great alternative right here. However, Albert also offers this without any membership or hidden fees associated with it.

In case you want instant cash, you might have to buy a paid membership for $8 a month but that is optional. Albert takes pride in the fact that there are real human ‘geniuses’ who drive the app.

Here are its key features:

- Lots of options other than cashback – including saving and investing

- Provides quite a few cashback on the purchase of certain products

- Membership isn’t needed to take a cash advance

- Real human ‘Geniuses’ answer your finance-related queries

Albert can be used to get cash advances anywhere in the US. There are no location-based restrictions as long as you are in the country.

One of the key problems that users of the Albert app face is that there are a ton of conditions that need to be satisfied to get cash advances. This is a rather comprehensive list.

Furthermore, there’s no real customer support option available on call too. Lastly, the $8 a month subscription for a ‘genius’ plan is rather on the steeper side.

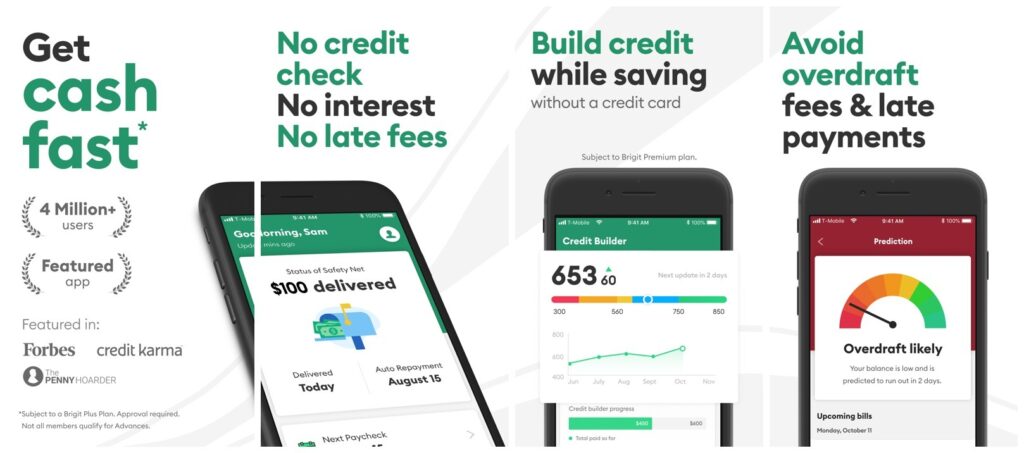

6. Brigit

Brigit’s Instant Cash feature gives you up to $250 in advance cash any time you want it. It is one of the ‘truly free’ options out there as Brigit doesn’t charge you any late fees or interests, and neither does it ask you to tip them. The only caveat is you need to buy their subscription.

Here are its key features:

- Brigit does not require any credit checks

- You can make your next cash advance withdrawal any time after your repayment – no monthly limits

- The credit Builder feature helps you build your credit score

- Does not charge any interest or late fees

Based out of New York, Brigit is accessible to citizens with a US bank account living in the US. The advance from Brigit goes straight into your account and can be used however you want it – via card, ATMs, etc.

Brigit is also a great app if you are looking forward to tracking your spending habits. A key limitation that you might face with the Brigit app is that it charges a $9.99 monthly subscription and that its customer support is only email-based.

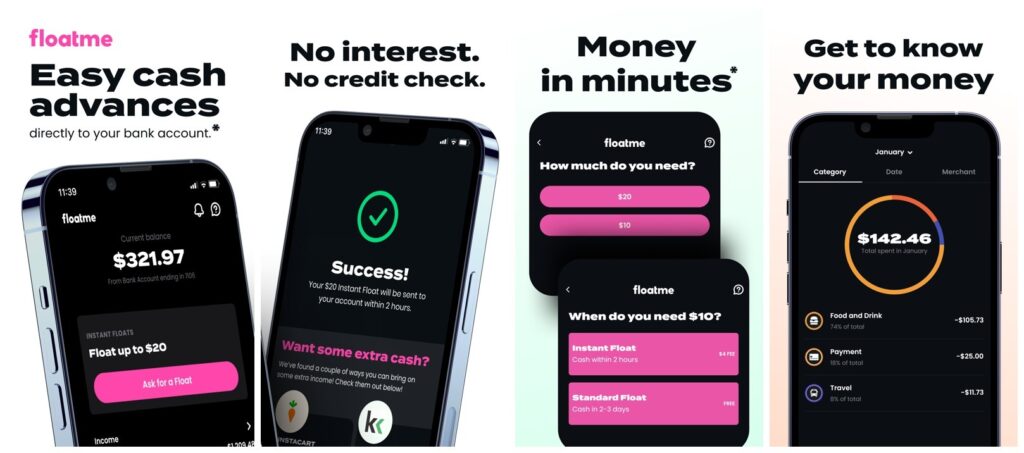

7. FloatMe

Facing an end-of-the-month cash crunch and want to stay afloat? FloatMe is among your best bets for it!

The FloatMe app is quite similar to Klover in terms of its functioning and betters it in terms of the overall user experience. This is a great app for small borrowings, as it lends only $50 in advances.

Key Features:

- FloatMe funds are deposited straight into your bank account

- Free transfer within 3 days, $4 for instant transfers

- The app does not require any prior credit checks

- Charges $1.99 in monthly membership fee

FloatMe app is available to users from all the states of the US. All you need is a bank account in the country supported by the app.

The FloatMe app is pretty decent in terms of the overall user experience and is pretty easy to navigate, but its key shortcoming comes in the form of the fund limits. It allows you to withdraw only $50.

This is a small amount even by the standards of cash advance apps. Furthermore, if you are a new user of the FloatMe app, you get an even smaller amount – usually ranging between $10-$30.

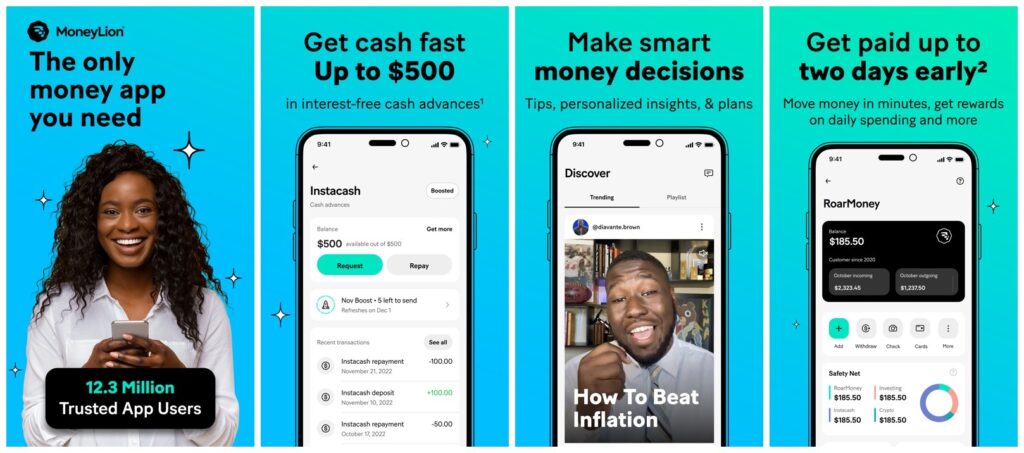

8. MoneyLion

If you are looking for an app that offers a higher limit of cash advances, MoneyLion and similar apps a good options for you. It offers an advance of up to $500 but isn’t just limited to providing cash advances.

The app is also a personal finance and mobile banking solution. If you happen to need larger funds, the app can help you get loans as well.

Key highlights:

- Offers advances up to $500 – one of the highest in the markets

- A $19.99 membership will also help you build your credit score

- 0% interest charged on advance cash

- Excellent customer care service provides on-call support as well

MoneyLion is available to anyone in the US who is at least 18 years of age and who has a history of a minimum of three recurring deposits from the same source. You will require a checking account that has to have a positive balance.

People who rely on cash advances might sometimes have a negative balance. Other than that, if you have a regular savings account, that won’t work with MoneyLion either.

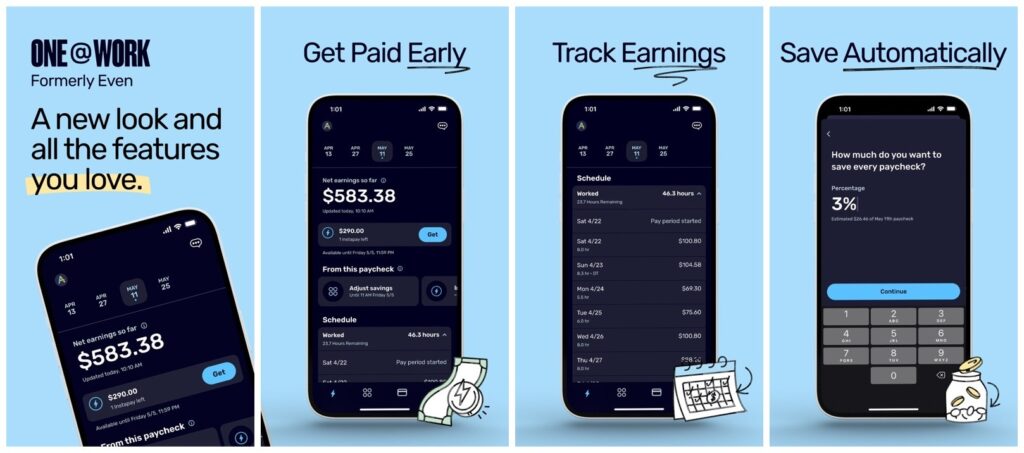

9. Even

Unlike most other apps on this list, Even works on a somewhat different system altogether. You need to be in regular employment, and your employer also needs to use Even in order for you to avail of the cash advances here.

If you make about $200 a day at your workplace, and you’ve been working for 10 days, Even will allow you to withdraw 50% of that ($1000) – which will then be deducted from your paycheck later.

Check out its key features:

- You can collect your cash from a Walmart store

- Even Plus membership of $8 per month is mandatory

- Quick bank transfers in just a day

- The app reminds you of pending bills and helps you budget your funds

The Even app is available across all states in the US. There are no location-specific problems that you might face while using it.

The biggest limitation that you are bound to face while using Even is that the app is only limited to users who have their employers tied up. If your employer does not use Even, then you will not be able to take a cash advance from the app.

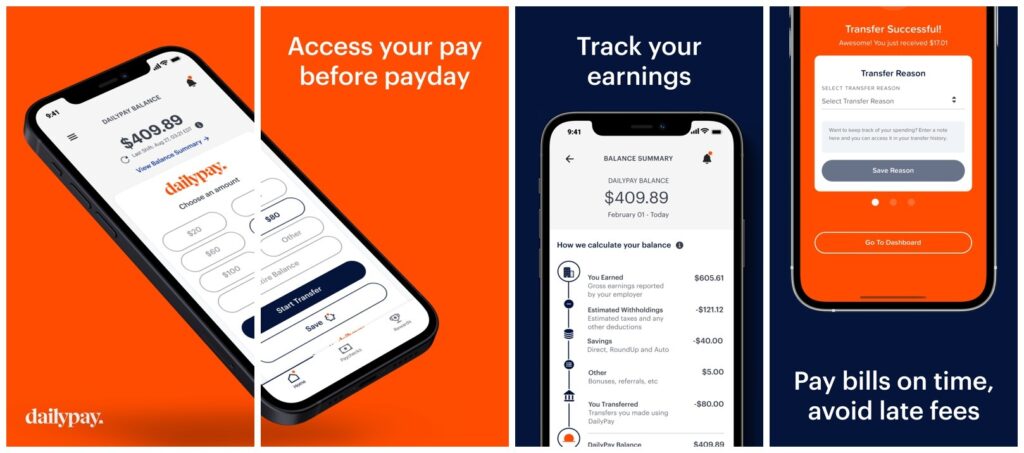

10. DailyPay

While Even provides you with 50% of your earned wages, DailyPay doubles it up and can provide you with up to 100% of your earned daily wages.

The app is a great employee-benefits solution and ensures that you can straight up put the money you earned to work on the same day itself!

Key Features:

- Transfers advance cash to a bank account or cards, depending on your choice

- No Social Security Number needed for fund transfers

- Funds reach you within one business day – one of the fastest out there

- Provides insights about your work hours and the corresponding money you earn

The Dailypay app is available across the US, but only under the condition that your employer uses it. You don’t even need to have a social security number to make use of DailyPay’s cash advances.

Much like Even, it also needs a formal tie-up with your employer and you will be able to use it only if your employer is using DailyPay. This is one of the biggest drawbacks and limiting features of this app. You might want to check with your employers beforehand.

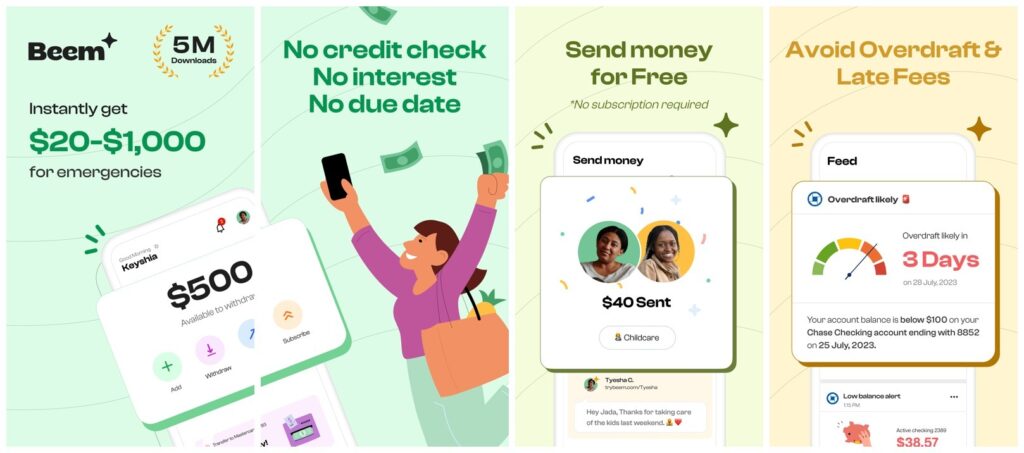

11. Beem

While most of the apps on this list offer anywhere between $250 to $500, Beem doubles the stakes and offers up to $1000 in cash advances.

Apart from giving you instant cash, the app also allows you to add money to the Beem wallet and send it across. You can even send money via email.

Beem also doubles up as a great money-managing app, giving you access to all your transactions and using AI to track your spending vs your savings.

Key Features:

- No credit checks are required to get cash

- You can file your federal as well as state taxes

- Improve your credit score

- Get quick access to car insurance

Beem works all over the US, and there are no restrictions in any state. It is fairly easy to get on it, especially if you have a regular recurring income in your bank account. Beem perhaps suffers from the problem of plenty. The app has a lot of good features, but sometimes it can be a little overwhelming.

Other than that, it looks like Beem isn’t able to manage the app’s stability too, as reviews on Play Store keep pointing out frequent crashes in the app.

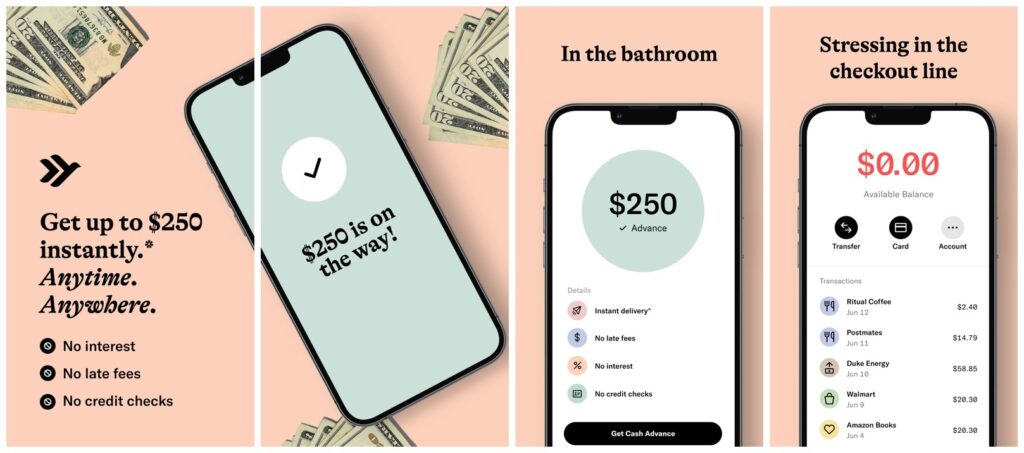

12. Empower

Last but not least, Empower offers you a cash advance of up to $250 and is one of the most credible names in the market.

We call it credible because Empower has lent out over $1.5 Billion in cash advances this year. It also comes with an interesting ‘AutoSave’ feature which ensures you can save enough money every month.

Key Features:

- No late fees and 0% interest

- Allows you to monitor as well as build your credit score

- You can track your spending habits using the Empower app

- 14-day free trial, following which you have to pay a $8 subscription

Empower is available to everyone in the US, provided their bank account supports the app. Also, you need to have a regular income with multiple recurring deposits from the same source in order to use it.

While the Empower app is otherwise pretty good, the one major red flag that you might want to keep in mind before you use it is that Empower will not notify you before it withdraws repayment funds from your account.

The repayment happens on your next payday and is automatic.

Frequently Asked Questions

Klover, Chime SpotMe, Cleo, Albert, Brigit, Empower, and MoneyLion are some of the apps that can give you $200 instantly. You might be charged a small fee for instant transfers.

Open the Cash app > navigate to ‘Borrow’ and click on it > request the amount you need > accept the terms and conditions after reading them. For smaller amounts, you might also want to check out the cash advance apps listed above.

Albert, Brigit, and Empower are some of the easiest apps to get a cash advance. However, to use these, you need to have regular employment where you are getting recurring payments from the same source. That is the only condition.

EarnIn, Albert, and MoneyLion are some apps that have customer service as good as that of Klover. These are all apps with 24×7 customer support, and some of them even provide on-call support.

Wrap Up!

Cash advance apps can often be a lifesaver in the literal sense. While on other times you might need it for smaller purposes – a puncture, sudden groceries, etc. However, if you are someone who needs a little extra at any time in the month, these are pretty good options when compared to getting PayDay loans.

Leave a Reply